Strategy

China Launches Wealth Management Connect

The scheme, which tightens financial and investment links between the former colonies to mainland China, has been in the works for some months.

Last Friday, China launched its Wealth Management Connect scheme which hooks up its southern province of Guangdong with neighbouring Hong Kong and Macau, a move designed to bind the two territories more closely with the mainland.

The scheme will initially lead to combined fund flows of Y300 billion ($46.53 billion) in the Greater Bay Area, Reuters reported.

Banks including HSBC, DBS and Bank of China (Hong Kong) applauded the launch, which has been in the works for months. Earlier in 2021, the Hong Kong-based family offices industry praised the scheme.

“We have been working very closely with the authorities on this

initiative and we warmly welcome its official launch today,”

Nelson Chow, chairman of HKIFA, said. “The scheme has important

strategic significance and represents an important step to

further foster financial integration in GBA [Greater Bay

Area].”

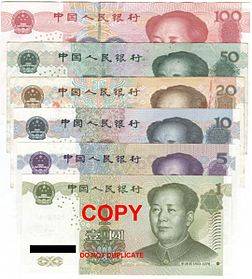

Chow said that for Hong Kong investors, the scheme offers more

renminbi-based products to choose from; and for investors from

other cities in the GBA, they can make use of eligible

HK-authorised funds to construct portfolios.

The programme enables residents of Hong Kong and Macau to buy mainland investment products sold by banks in the Greater Bay Area, while allowing residents of nine Guangdong cities to buy those sold by banks in the two offshore centres. The development is similar to the Stock Exchange schemes arranged between Hong Kong and the mainland which were launched a few years ago in a bid to boost local equity markets. It also follows the Hong Kong/China Mutual Recognition scheme that came into force in 2015 (see here).

The move comes at a time when Beijing has been liberalising its capital markets to encourage foreign investment inflows, a fact that has stoked controversy.

There are also parallels with other regions’ moves to integrate financial markets. For example, the European Union’s UCITS regime for funds enables investors to buy and sell funds across the EU without having to register them separately in each jurisdiction. In turn, the US benefits from a large, integrated funds and investments market.

“WMC is ground-breaking and will further bolster the financial services industry in the GBA. HSBC aims to be among the first batch of banks to launch WMC investment service, with manpower, infrastructure, processes, products and services all lined up and ready,” David Liao, co-chief executive of The Hongkong and Shanghai Banking Corporation Limited, said.

“Meanwhile, we expect the demand will continue to grow with increasing economic integration among GBA cities, and WMC will provide Hong Kong investors direct access to a larger variety of RMB products in the longer run. A recent HSBC survey found that mainland investors in the GBA show strong interest to invest via WMC,” Liao said.

“The initiative not only brings new impetus for the wealth management industry in the GBA, but also helps promote the high-quality development of the financial industry in the region, as well as the internationalisation of Renminbi,” Sun Yu, vice chairman and chief executive of Bank of China (Hong Kong), said. “With its preparations in full swing, BOCHK aims to launch the cross-boundary wealth management service as soon as it obtains the regulatory approval. We have also been working collaboratively with the GBA branches of Bank of China, our parent bank, in various aspects including customer experience optimisation and investor protection.”

Sebastian Paredes, CEO of DBS Hong Kong, said: “With the launch of the Wealth Management Connect, we see immense opportunities in expanding our business into China, anticipating a quarter of our HK Treasures Wealth customers will come from GBA in the next three years.”

“The launch of this new scheme will widen the scope of investment opportunities available to clients of the Greater Bay Area, and is an important step toward realising the potential of the Greater Bay Area to become a leading global hub of wealth creation and management,” Amy Lo, chairman, executive committee of The Private Wealth Management Association in Hong Hong, said.