White Papers

Central Bank Digital Currencies: Impact On Financial Inclusion, Private Sector Banks

Central bank digital currencies are being considered by a raft of countries. They bring, so advocates say, all kinds of pro-innovation benefits. They are also privacy concerns, however, to be taken into account. This article takes a look.

The article is part of the law firm’s "The Next Decade in Fintech" series, and the editors of this news service are pleased to share this. This publication has already examined central bank digital currencies (CBDCs), such as their implications for financial innovation, privacy and concerns about their use in surveillance.

We are grateful to Baker McKenzie to be able to republish this material. The usual caveats apply and to respond, email tom.burroughes@wealthbriefing.com

The world’s central banks understand that the future of money is digital. As payments shift online, the use of cash declines and the fortunes of crypto assets rise and fall, central bankers realise that their ability to command the use of money in their economies could weaken and that the financial exclusion of un- and underbanked citizens could be cemented. To try and forestall such developments, central banks in all the world’s major economies and most of its lesser ones are exploring the creation of digital currencies, and a handful of emerging economies have already launched their own.

The widespread introduction of central bank digital currencies (CBDCs), especially in the world’s major economies, is not imminent. But the groundwork being conducted in this area is detailed and in-depth, such that many central banks will be ready to launch when their governments deem the circumstances to be right. Before that time comes, central banks have choices to make about the design of their CBDC systems, particularly those earmarked for retail use. We spoke with two experts to understand what some of those options are and how the choices made may have an impact on financial inclusion and the role of private sector banks in this new payments landscape.

The state of play

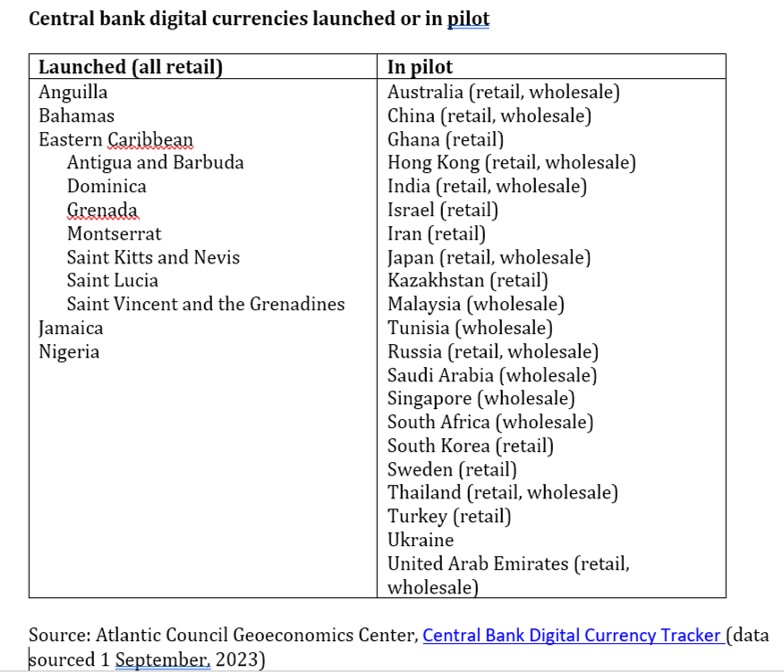

As of June 2023, 11 countries or their currency unions had fully

launched digital currencies, 21 had embarked on pilots, 32 had

them under development and another 46 were at earlier stages of

researching them. Some initiatives are exclusively for retail

CBDCs (including the 11 already launched), some for exclusively

wholesale ones, and several large economies (such as China

(1), the US, and the eurozone) are exploring the launch of

both.

Except for Nigeria, all of the 11 that have launched CBDCs thus far are small economies in the Caribbean region. Why their speed to launch? According to Marion Laboure, senior strategist at Deutsche Bank Research and co-author of a recent white paper on digital currencies, a major motivation for them is to expand financial inclusion, as most have large numbers of un- and underbanked citizens. For Nigeria, says Ashlin Perumall, a partner in Baker McKenzie’s Johannesburg office, an additional impetus is to shore up the use of its own currency in domestic payments, thereby reducing the use of the dollar, as well as increasing the visibility and traceability of money flows. “There and in other African countries, CBDCs could solve problems that aren’t currently being solved,” Perumall says.

There is currently less urgency in larger, wealthier economies to move towards a CBDC launch. Singapore is a case in point. After completing a pilot in late 2022, its central bank, the Monetary Authority of Singapore (MAS), stated: “The use cases for a retail CBDC are unclear, given that electronic payments…are pervasive, and households and firms … are already able to transact digitally in a fast, secure and seamless manner today.” Speaking of wealthy economies more broadly, Perumall also cites the travails of cryptocurrency markets as a reason for central banks to hold off. “Crypto threats to sovereign liquidity have receded somewhat in the past year,” he says.

The experts we interviewed nonetheless expect several major economies to launch CBDCs this decade. “It’s a question not of if but of when,” says Laboure.

A boon to inclusion

Bringing the unbanked into the financial mainstream is one of the

principal advantages that a CBDC offers particularly, as noted

earlier, to less developed countries with large percentages of

unbanked in their population. A key feature of many retail CBDC

projects is the ability of individuals to access a digital

currency account offline as well as online. “This is important as

it effectively decouples financial inclusion from access to the

internet,” says Laboure. Thus, people will be able to make CBDC

transactions over basic mobile devices, using stored value cards,

for example, or even text messages.

The financial inclusion benefit is not a given warns Perumall. “To lay claim to this feature, the system for a CBDC needs to be designed with inclusion in mind,” says Perumall. Offline access is one such design element, but there are more. For example, the system must be interoperable with the diverse payment mechanisms used in an economy, and it must be accepted by merchants. It also requires simplified KYC (know-your-customer) and AML (anti-money laundering) processes.

Where the private sector fits in

Implicit in the above – and an altogether new departure in the

history of banking – is the existence of a direct relationship

between individual citizens and their country’s central bank, in

which the former hold a CBDC account with the latter. In some

countries’ designs, citizens may use a mobile app to access that

account directly, but it is more likely that private sector banks

will play the role of intermediary in a two-tiered digital

banking system.

There are nevertheless concerns that central banks could compete with retail banks for CBDC transactions, especially if the former opted to offer interest-bearing accounts. While not excluding that possibility, Perumall downplays disintermediation concerns. “Private sector banks not only provide the mechanism for distribution of money into an economy,” Perumall says, “but they also provide the services and the management of such services that go along with it – things that no central bank has the capacity to do.”

Concerns also exist that CBDC accounts could exacerbate a banking crisis if customers began shifting funds from their retail banks to the safer haven of the central bank. In Perumall’s view, however, the two-tiered system of most CBDC designs, along with non-interest-bearing accounts and limits on CBDC holdings, provide a safeguard of sorts against the possibility of bank runs.

Laboure similarly sees no CBDC threats to financial stability due to the same factors: their two-tiered design, zero interest accounts and caps on holdings. “Moreover, looking at countries where CBDCs are live, current adoption rates are low,” Laboure adds.

Preparing for the day

As the example of Singapore suggests, the possibility of an

extended wait for the widescale introduction of retail CBDCs is

real. There is, after all, ample scepticism among politicians,

and even some central bankers, about the very need for CBDCs. “A

solution in search of a problem?” is a recurring question about

CBDCs asked in recent months and years by authoritative sources

who posit the view that a digital currency offers more risk than

reward.

Private sector banks should not, however, assume that launches will be delayed indefinitely. Singapore’s MAS, for one, has made clear that it could bring forward the launch of its digital currency if “innovative uses emerge or there are signs that digital currencies not denominated in [Singapore dollars] are gaining traction as a medium of exchange locally.”

Retail banks will need to make preparations. That means, for example, readying their technology systems to be able to process CBDC transactions at scale; creating electronic wallets or other end-user interfaces so that their customers can begin making CBDC transactions; and developing ideas for new services associated with the management of CBDCs. It is not too early for banks to begin taking such steps.