Emerging Markets

India's Equities Are Promising Long-Term Prospect - Nomura

A correction in the Indian stock market should be an opportunity for investors to get into the game, given positive longer term economic prospects.

India’s economic growth prospects are positive in the long term but markets have been buffeted by headwinds recently, and falls in prices give investors a chance to get into the market, according to Nomura Asset Management.

“India has delivered the fastest economic growth among the larger countries, and we expect this trend to continue into the medium- to long-term. In addition to demographic advantages, a primary factor, policy contributions such as political reforms and efforts to resolve non-performing bank loan problems are also contributing to its strength,” Vipul Mehta, head of investment, said.

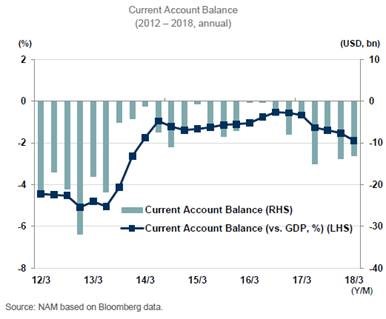

“However, in the most recent six months, there have also been some short-term head winds, such as the current account deficit, which has expanded along with the rise in oil prices and an outflow of funds from emerging markets as a whole caused by rising long-term interest rates in the US,” Mehta said, adding: “Under such circumstances, for longer term investors, a short-term correction is considered to be a good opportunity to purchase Indian shares at a reasonable price.”

So far this year, the MSCI India index of equities is down 0.6 per cent, when measured in dollars. That contrasts with the 8.26 per cent fall in the wider MSCI Emerging Market index.

Nomra’s Mehta said domestic demand expansion and infrastructure developments are its main investment themes, focusing on "financial services for individuals (banks, insurance, investment trusts)“, “daily necessities“, "capital goods“, and "general consumer goods".

Among near-term headwinds to growth is a widening current account deficit.

“India is highly dependent on oil imports, so the trade balance has deteriorated due to the recent rise in oil prices. Exports are sluggish as well, having missed a ride on the wave of worldwide trade volume expansion. The manufacturing industry appears to be one of India's fundamental weaknesses. Due to this rise in the current account deficit, there is substantial downward pressure on the rupee in the short term. However, this cloudy immediate outlook does have a silver lining,” Mehta said.

Indian authorities has intervened to buy rupee due to abundant foreign exchange reserves, which have increased by approximately $100 billion over the last five years, leaving plenty of scope for further interventions. A positive move has been a policy rate hike by the Indian central bank, the investment firm said.

“Although we have outlined the market risks associated with the rupee, we also think the investment environment in India presents many positive features, even in the short term,” Mehta said. “For example, corporate earnings, where earnings for Jan - Mar 2018 were generally good. Unlike last year when there was a temporary decline due to the introduction of goods and services tax (GST); this year we expect an earnings per share growth rate of approximately 15 per cent,” he continued.

Mehta said there remains a continuous steady inflow of capital from domestic investors.