Investment Strategies

GUEST ARTICLE: A New Paradigm In Bond Markets - Lombard Odier Investment Managers

.jpg)

The world of fixed income has changed utterly, reckons the author of this piece, who goes on to discuss how wealth managers should consider the asset class going forward.

The bond market has been through an extraordinary period in recent years, with heavy central bank purchases, negative interest rates in some countries such as Japan and Switzerland, and continued strong purchases of long-dated maturities by pension funds. The market for bonds has in some ways become less liquid as a result of central bank buying to drive QE programmes. So many aspects of what bond market professionals took for granted a decade ago have been chucked out of the window. So is it high time that wealth managers took a new approach?

Salman Ahmed, chief investment strategist at Lombard Odier Investment Managers, would give a qualified “yes” to that question, and argues that fixed income markets are moving into a different world. With that in mind, he sets out his views on how advisors to high net worth clients should think. As ever, the editors of this news service are delighted to share these views with readers and urge readers to respond; the editors do not necessarily agree with all guest contributors. This publication is a platform for the industry to set out opinions – so please contact us. Email tom.burroughes@wealthbriefing.com.

The status-quo of fixed income investing is wholly ill-equipped to deal with new market realities. The new investment paradigm leaves investors with little choice but to rethink fixed income investing in order to mitigate today’s challenges while pursuing their objectives.

Investors are facing a number of important challenges when it comes to global fixed income investing, including widespread low yields, increased market risk, and fractured liquidity.

A material cost of negative carry in fixed income allocations is forcing the search for yield. Even though the US election alleviated some pressure, the fundamental drivers of low rates in non-US developed markets remain.

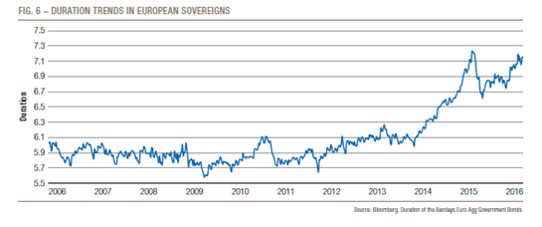

As a result, investors have extended duration to find positive yields and now face a heightened sensitivity to moves in interest rates. Bond markets are also now providing lower diversification benefits given the increased correlation with equities. Furthermore, as investors are increasingly forced into taking the same positions given the shrinking investment universe described below, this herding effect raises the likelihood of future liquidity incidents.

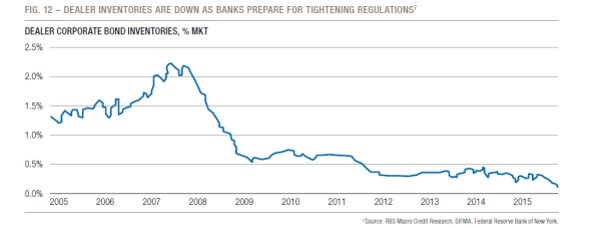

Investors should be under no illusion - liquidity is fractured in

fixed income markets stemming from two main causes. Firstly, the

unconventional monetary policies of central banks mean they have

bought and hold up to 30 per cent of all outstanding government

debt, therefore reducing the free-float of major sovereign bond

markets. Secondly, tightening regulation such as Basel III is

strongly reducing banks’ ability to hold and trade fixed income.

There has been a sharp drop in corporate bond inventories held by

the banking sector relative to the size of the market as a

result. Banks are acting more like brokers than principals.

The nature of duration has changed

Investors must also reassess duration. While history has been

supportive of long-term returns from duration exposures, a key

driver of this has been a fall in interest rates; the direction

of monetary policy points to limited potential for rates to move

lower, damaging the return potential of duration.

In the US, sentiment on rates turned distinctly hawkish following the election result, which was then confirmed by restarting of the hiking cycle; the probability of fiscal interventions has increased (though significant legislative hurdles are coming to the fore) creating negative pressure around duration risk dynamics. That said, in Europe, monetary policy continues to be very accommodative with the European Central Bank expanding its quantitative easing programme to include credit recently, hence extending the direct influence of monetary policy beyond duration. The possibility of yield curve control is more likely now in Europe in our view, given the spill-over from the US economic dynamics. This would mean that duration ceases to adequately perform any of the key functions it has historically been associated with, namely: long term returns, capital preservation, diversification and liquidity.

It is time to rethink the investment approach

Investors need to change their approach to account for the new paradigm in fixed income markets by building quality-driven portfolios and trading less.

In a world where you cannot easily trade, the starting point, when it comes to portfolio construction becomes a critical decision. Today, the vast majority of investors apply traditional market-cap bond indices as their starting point. This represents a significant issue as market-cap indices reward leverage and give a higher weight to the most indebted issuers - a design flaw which is amplified in the current fractured liquidity environment. Often investors turn to active managers to mitigate the flaws in market-cap, but we can expect increasing pressure on higher turn-over active management as higher trading costs and lack of frictionless trading erodes performance.

In order to tackle some of today’s challenges, investors should trade less and build safer portfolios that exhibit quality. To achieve this, investors should install explicit default risk mitigation at the heart of their portfolio construction process, considering fundamentals-driven portfolio construction approaches within a low turnover framework that focus on credit default mitigation.

Moving down the credit spectrum to find yield

To find yield in the new investment paradigm investors should

continue to move prudently down the credit spectrum. The changed

nature of duration provides a further reason for reassessment.

Increasing exposure to credit risk through an allocation to

corporate credit is a sensible option for investors.

However, investors need to look beyond the investment grade

segment of the corporate credit market where the dominance of

duration will limit potential returns. To sufficiently increase

their credit risk exposure investors should move further down the

credit spectrum.

The so-called crossover universe – which spans the lower quality investment grade (BBB) and higher quality high yield (BB) rated issuers – provides significant return enhancement relative to investment grade issuers while not exposing investors to the excessive default risk that is a feature of high yield (rated B and below) debt. The inclusion of “fallen angels” – corporate credit that has been downgraded from investment grade and is initially undervalued due to market inefficiencies – is a key driver of the attractive spread returns seen in the BB segment and therefore captured by the crossover universe.

Seeing the bigger picture is important for diversifying portfolios

While a quality-driven, low-turnover crossover credit portfolio can help investors to meet their yield and capital preservation objectives, what about their need for a highly liquid portion of their portfolio? For this, investors need to accept that fixed income is no longer the answer and instead explore strategies that are better able to provide liquidity in the new investment paradigm; this includes liquid multi-asset strategies that combine both traditional and alternative risk premia.

The new investment paradigm poses serious and lasting consequences, forcing investors to rethink how fixed income investing can work for them as they pursue their objectives.