Investment Strategies

GUEST ARTICLE: Yes, Impact Investing Really Can Generate Alpha - WHEB Asset Management

A practitioner in the field known as impact investing examines the evidence with a mass of data.

Impact investing is a term increasingly in use in the wealth management industry, but amid volatile markets and negative real interest rates in some countries, scepticism about this approach is perhaps understandable. Can impact investing make a positive difference to the hard numbers in a portfolio as well as deliver non-financial goals? This guest article by Ted Franks, a partner at WHEB Asset Management, and fund manager for the FP WHEP Sustainability Fund, says the answer to this question is yes. As ever, the editors welcome contributions to debate but do not necessarily agree with the views expressed and invite responses.

In the wake of the Brexit vote there has been a renewed cry for responsible capitalism – to reconnect with the poor and disenfranchised whose vote was a protest against the establishment. This is not new. There was the same response following the financial crisis. But this time around it appears the conditions may be in place for a more significant response. Is this trend a straightjacket for business, necessarily bad for the economy, for corporate profits and therefore for investment returns? Or could it surprise the sceptics and be a spur to genuine long-term value creation?

Impact investing

Traditionally, “responsible capitalism” has been thought of as

the preserve of charities, foundations, and the philanthropic

few, whilst the rest of the market gets on with a focus on profit

maximisation.

However, there have been profound shifts in thinking within financial markets as an increasing number of companies and investors are now making “good profits” a fundamental part of their strategy.

The shift is well articulated by the move from shareholder to stakeholder value. We know that too narrow a focus on profit leads to short-termism and wealth destruction, especially when incentives are poorly aligned.

A more inclusive form of capitalism looks at and manages stakeholder risks and opportunities across the customer, employee and supply chain and takes into account externalities that pose hidden risks, such as climate change.

Michael Porter, the Harvard academic famous for “Porter’s 5 Forces” analysis of industry value chains in the 1980s, has re-emerged in recent years with a theory of “Shared Value” . In today’s highly complex, fast moving and volatile world a much more nuanced and participatory approach is needed to create and preserve wealth.

Step forward impact investing.

(notes)

1. See for instance:

http://www.investopedia.com/terms/p/porter.asp

2. See

http://sharedvalue.org/partners/thought-leaders/michael-e-porter

A brief history

Impact investing was first conceived by foundations and

philanthropists as a way to use their capital to support their

charitable objectives alongside their grant-making activities.

The FB Heron Foundation, a leading US impact investor, characterised grant-making alone as being like working with one hand tied behind your back. So the question they asked is: “How do we deploy more of the assets in our portfolio so that they are aligned with solving the problems we want to fix?”

Initially, the foundation made small operational steps focused on making the best use of active, index and enhanced funds to free up time for grant making and engagement whilst lowering costs without increasing risk or reducing returns.

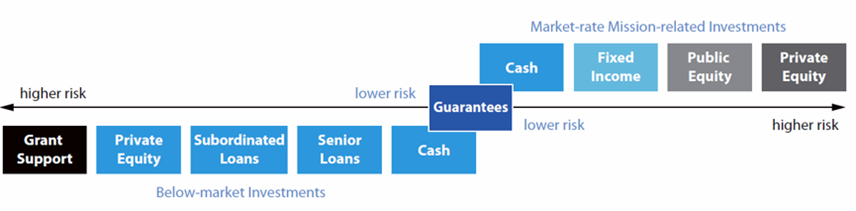

As the investment process was validated, Heron’s approach gradually moved towards incorporating its total asset base into an impact approach as illustrated in the chart below:

Heron’s Mission-Related Investment Continuum

(note)

3. See: http://heron.org/market

How is this relevant to wealth managers?

Wealth managers and their clients need frameworks to make sense

of and navigate the world.

We know markets are not efficient as they are riddled with behavioural biases and externalities and that simply chasing profits is a recipe for disaster, and yet many investors are still too focused on benchmarks.

An alternative is to start with “intention”, by offering clients the potential for their investments to make a positive impact in the world.

This can improve portfolio efficiency by introducing new and different sources of alpha. Just as valuably, possibly more so, it engages clients in a conversation that can be profoundly motivating.

At WHEB we have created a framework that can help wealth managers and their clients to position their portfolios for impact as a source of alpha and as a commercial way of exploring values at a more meaningful level.

Economic rationale

The backdrop of low growth and high debt alongside the challenges

of demographic, environmental and technological change is

reshaping the global economy.

In our view, this has already led to large shifts between sectors within traditional benchmarks.

For instance, the energy sectors, including oil and gas, coal and mainstream electric utilities, have in recent years fallen significantly both in absolute and relative terms.

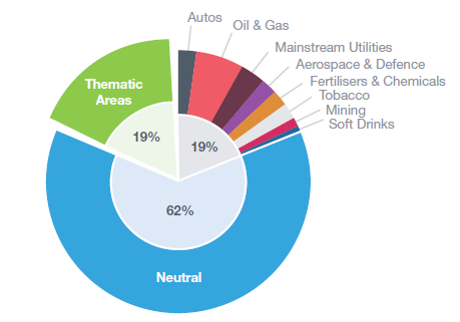

In total, industries that WHEB has categorised as having significant negative social or environmental impacts accounted for 28 per cent of the MSCI index in 2009, falling to just 19 per cent seven years later.

.png)

Source: WHEB Annual Impact Report 2015

Better classification

We classify most of these businesses as having “degenerative”

business models.

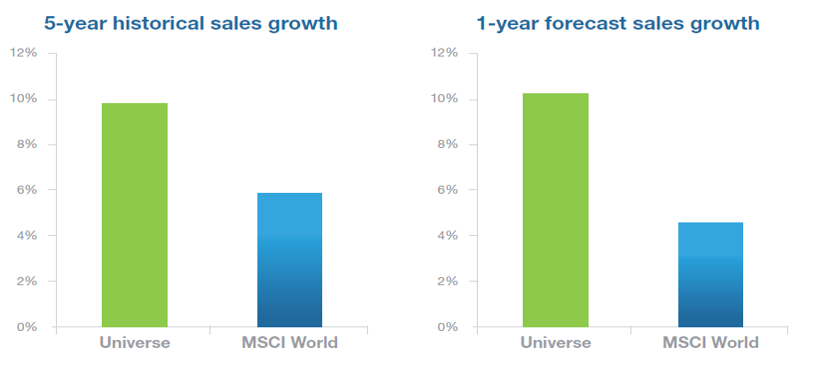

On the positive side, it is not a coincidence that “generative” companies are growing their share of the MSCI with higher historic and forecast sales growth.

Sales growth for WHEB’s universe versus MSCI World Index

Source: WHEB Annual Impact Report 2015

Universe: Around 1,100 global large and mid cap positive impact companies

WHEB seeks out high positive impact stocks, companies which are actively solving rather than exacerbating society’s challenges.

Currently, this means looking mainly outside of the MSCI, albeit at large and mid-caps with established profitability across multiple sectors.

However, our universe of stocks has been consistently expanding over the past 10 years as the trend for making money out of solving some of humanity’s biggest challenges has become established.

Developing market

In its report, Investing in a Time of Climate

Change, the investment consultancy Mercer provides

two key ways of looking at the risks of disruption to business as

usual.

Firstly, by ranking and comparing short-term and long-term global risks it serves to show where long-term investors need to focus their attention.

Secondly, by using scenario analysis it is possible to start modelling the downsides of specific market risks created by climate change as well as map out wealth protection and value creation strategies that navigate these risks effectively.

There are now a wide array of frameworks, such as Mercer’s, Heron’s and WHEB’s, that can be used to assess impact across asset classes. These help investors to understand and appreciate how investments can contribute to a better world whilst also creating genuine long-term wealth.

Next steps

We are seeing increased interest and flows into our fund from a

range of wealth managers across different investment strategies.

Certain customers and client segments may be more inclined to put

their money to work in a way that is closer to their

values.

For instance, there is evidence that so called millennials are more motivated by impact investing and young tech savvy entrepreneurs or professionals that have made a career in the sustainability sectors are also attracted to this area.

Impact investing has for many years been largely the preserve of high net worth families, philanthropists and foundations. We believe that we have reached a tipping point in the wealth management and institutional market which will see impact investing assume a more central and visible role for a much broader group of investors.

(Note)

4. The growth rates of the universe are weighted average growth rates based on their current market capitalisations. The growth rates of the MSCI World are weighted average growth rates of the constituents based on their weightings in the index. The five-year historical sales growth of individual stocks is calculated as: [((most recent sales / sales five years earlier) ^ 0.2) -1] * 100. The one-year forecast sales growth of individual stocks is calculated as: [(sales estimate for current financial year / comparable sales a year earlier) – 1] * 100. Source: Bloomberg (five-year and one-year data are the latest available from Bloomberg as at 31 December 2015).

About the author

Before joining WHEB, Franks was a sector specialist in the

renewable energy and utilities sectors at Dresdner Kleinwort and

KPMG. He is a chartered financial analyst and chartered

accountant.