Compliance

The New UK Prospectus Regime – What People Need To Know

For those in the private banking and wealth management field who are looking at initial public offerings in London, and the mechanics of the country's listings for companies, there is a new set of rules in force – effective as of 19 January. A major law firm walks explains what's going on.

This publication is pleased to share this content – with permission from international law firm Squire Patton Boggs – on issues stemming from a new business prospectus regime that took effect in the UK a week ago.

The new regime, which is a framework for equity capital markets transactions, is important for those in the private banking and wealth management space who need to be aware of the changes. Policymakers in the UK are trying to make the listings system in the UK more attractive, to attract capital back to the London Stock Market, and wider financial sector. Whether these efforts prove fruitful remains to be seen, but it is important for the UK’s ability to hold these “liquidity events” – an important source of new HNW individuals. We hope the article prompts discussion.

The editors are pleased to share these views; the usual

editorial disclaimers apply to opinions of guest writers and we

urge readers to jump into the conversation. To get involved,

email tom.burroughes@wealthbriefing.com

and amanda.cheesley@clearviewpublishing.com

The UK’s new prospectus regime, which came into force on 19 January 2026, looks at the key takeaways under the new regime for equity capital markets (ECM) transactions.

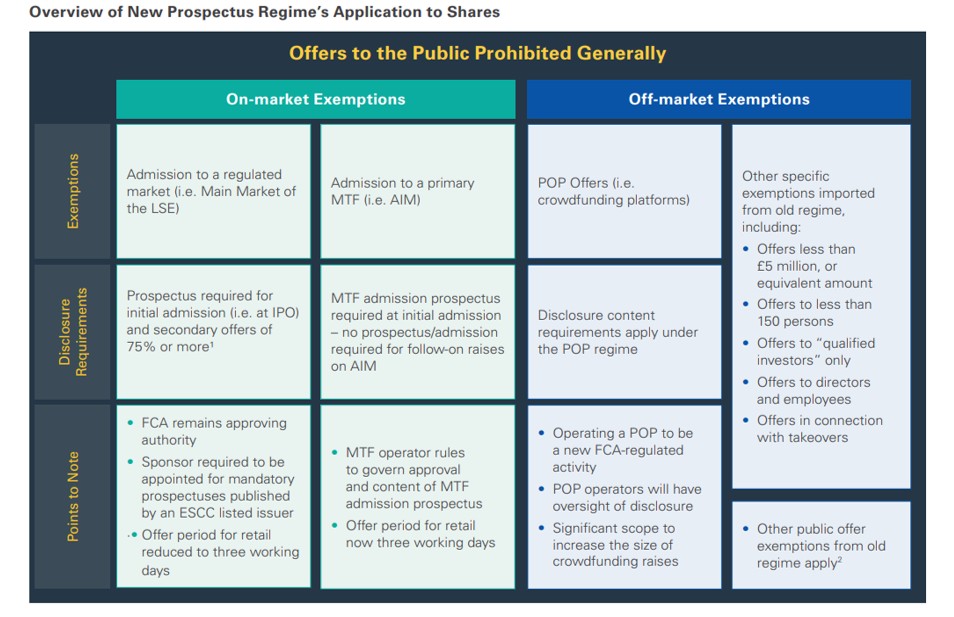

Following, the implementation of the new regime, the UK will no longer follow the previous “dual trigger” regime, which required a prospectus to be published for (i) the admission of shares to a regulated market and/or (ii) if an offer to the public was to be made, with each limb being subject to several exemptions. Instead, under the new regime, offers of shares to the public will generally be prohibited subject to exemptions, which include where the relevant shares are to be admitted to a regulated market (such as the main market of the London Stock Exchange (LSE) or a primary multilateral trading facility (MTF) (such as AIM).

Other off-market exemptions to the general prohibition will apply including where shares are offered to the public via a “public offer platform” (POP), ostensibly a crowdfunding platform, which will be a new Financial Conduct Authority (FCA) regulated activity. The previous exemptions to the offer to the public limb under the former regime have also been retained as exemptions to the general prohibition on public offers under the new regime, including where the offer is for less than £5 million ($6.83 million) (taking into account other applicable offers within a 12-month period), which replaces the previous €8 million ($9.48 million) cap, made to fewer than 150 persons in the UK or made to qualified investors only.

A takeover exemption has also been retained provided the shares being offered as consideration are not to be admitted to a regulated market or MTF, and a written statement containing certain prescribed information accompanies the offer. It will no longer be possible to carry out a public offer by publishing a prospectus, the relevant offer will have to fall within an exemption.

A prospectus will still be required to be published when applying for admission of shares to a regulated market for the first time (and depending on its size, on a post-initial public offering (IPO) admission as well). Similarly, a company’s first admission to a primary MTF will require the publication of an MTF admission prospectus (in lieu of the current requirement for an admission document). From a documentation perspective, market practice on IPOs will, therefore, largely be unaffected by the incoming reforms, although, as explained below, practice on post-IPO pre-emptive issuances could change.

Overview of new prospectus regime’s application to shares

Footnotes to chart

1, The old exemptions from having to publish a prospectus for

an admission of ordinary shares to a regulated market have also

been retained under the new regime – these, in summary, are: (i)

conversion or exchange of other transferable securities; (ii)

shares resulting from conversion or exchange or other securities

under the banking and central counterparty special resolution

regime; (iii) shares issued in substitution for shares of the

same class; (iv) shares issued in connection with a takeover; (v)

shares issued in connection with a merger or division; (vi)

shares allotted to existing or former directors or employees; and

(vii) shares already admitted to a regulated market subject to

certain conditions, principally that they have been admitted for

18 months or more on another regulated market and were

subject to an approved prospectus or equivalent when admitted.

The FCA has issued guidance on the content of prospectus

exemption documents for takeovers, mergers and divisions where

such documents are required to be prepared under the new

Prospectus Rules: Admission to Trading on a regulated Market

sourcebook.

2, Other exemptions to the general prohibition on public offers include (i) offers to existing shareholders, (ii) offers to persons already connected with the offeror company and (iii) securities offered under banking or central counterparty special resolution regime.

Key ECM takeaways

Further issuances on a regulated market

The biggest change to be implemented under the new regime is the

increase to the threshold that a prospectus is required to be

published for post-IPO issuances of shares within a 12-month

period from 20 per cent to 75 per cent of the number of shares

already admitted to trading to a regulated market. If a

prospectus is required to be published, the issuer may, subject

to certain conditions, elect to publish a “simplified” prospectus

instead.

Issuers will be able to publish a prospectus (which will have to comply with all prospectus content requirements and be approved by the FCA) voluntarily at a lower threshold than 75 per cent. An issuer will be required to appoint a sponsor when a prospectus is required to be published, but such an appointment will not be required for the publication of a voluntary prospectus.

Content requirements for a prospectus

Other than the introduction of specific climate-related

disclosure requirements for issuers who identify climate-related

risks or opportunities in their prospectuses, as well as a small

number of changes to the presentation of information included in

the summaries of prospectuses, the content requirements for

prospectuses under the new regime replicate those under the old.

The FCA has published updated guidance for issuers with complex

financial histories (for instance when they have carried out

acquisitions or disposals during the three-year financial period

covered by the prospectus), which provides additional flexibility

than was the case previously. Working capital statements will

still be required to be included in prospectuses (3) and the FCA

is due to make further consultations on their format in

2026.

Footnote 3, The FCA has indicated that it will engage further with market participants in 2026 on a three-tiered approach allowing issuers to make a working capital statement with either: (i) a clean statement, (ii) a clean statement with financing judgements or (iii) a qualified statement. For now, the FCA’s existing guidance on working capital statements continues to apply AIM.3. The FCA has indicated that it will engage further with market participants in 2026 on a three-tiered approach allowing issuers to make a working capital statement with either: (i) a clean statement, (ii) a clean statement with financing judgements or (iii) a qualified statement. For now, the FCA’s existing guidance on working capital statements continues to apply AIM.

Protected forward-looking atatements (PFLSs)

Under the new regime, those typically responsible for a

prospectus (i.e. the issuer and its directors) will be able to

benefit from a lower standard of responsibility for certain

forward-looking statements included in the prospectus.

Instead of a negligence-based liability standard, which applies generally to information included in prospectuses requiring those responsible for the document to show that the information was produced on a reasonable basis, PFLSs will be subject to a fraud or recklessness standard with the burden of proof being on the investor claiming loss. PFLSs will need to comply with certain requirements to be subject to the lower standard. Financial and operational information will be capable of being covered although a profit estimate for a financial period that has finished (as opposed to a profit forecast for a period which has not yet been completed) will not. The new regime will require PFLS to be presented in a specified manner in the prospectus and for prescribed disclaimers to be included.

Reduction in the length of retail offer period on

IPOs

Retail offer periods on IPOs will be reduced from three to six

working days under the new regime. The FCA hopes that shortening

such periods will encourage more issuers to carry out retail

offers on IPOs.

MTF admission prospectuses

Applicants to primary MTFs will be required to publish an MTF

admission prospectus. As is currently the case for admission

documents, MTF admission prospectuses will not require FCA

approval; their contents will be governed by the relevant MTF

operator’s (such as the LSE in the case of AIM) rules. Since an

admission of securities to a primary MTF is an exemption to the

general prohibition on public offers under the new regime, MTF

admission prospectuses can be used for retail offers that exceed

the revised ÂŁ5 million cap mentioned above. MTF operators will

have the discretion to decide when an MTF admission

prospectus is required for post-IPO share issuances. AIM

has confirmed that no MTF prospectus or admission

document will need to be published by AIM companies on

post-IPO fundraises (as is currently the case).

The current exemptions from having to publish an admission document available under the AIM designated market and Aquis Stock Exchange (AQSE) fast track routes have been retained, as has the requirement for one to be published following a reverse takeover. The statutory responsibility, advertisements, supplementary prospectus, withdrawal rights and PFLSs requirements applicable to regulated market prospectus will also apply to MTF admission prospectuses.

Our thoughts

Main market

Issuers will be able to carry out larger secondary offers without

needing to publish a prospectus, but it remains to be seen

to what extent market practice will gravitate towards the maximum

75 per cent threshold or settle for publishing voluntary

prospectuses or, potentially, some other form of offering

document (not approved by the FCA) at a lower limit (albeit a

higher one than 20 per cent). UK fundraises involving US

shareholders will, in all likelihood, see the publication of

voluntary prospectuses or offering documents at lower

thresholds.

Absent of preparing a voluntary prospectus or offering document, issuers will be carrying out larger equity raises using their ordinary course public disclosure (annual reports, interim reports and trading updates) than they have in the past. Above all though, the new regime should facilitate including existing retail shareholders in secondary fundraisings carried out by listed companies as well as retail investors more generally on IPOs. Similarly, the new regime will make retail investor participation on secondary selldowns (for instance a post-IPO block trade) easier, although the requirements of the UK financial promotion regime will need to be followed.

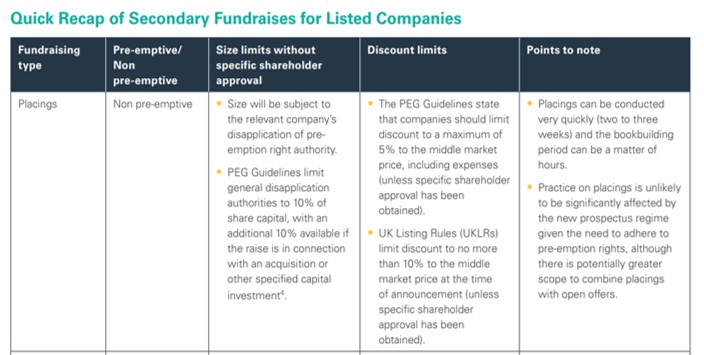

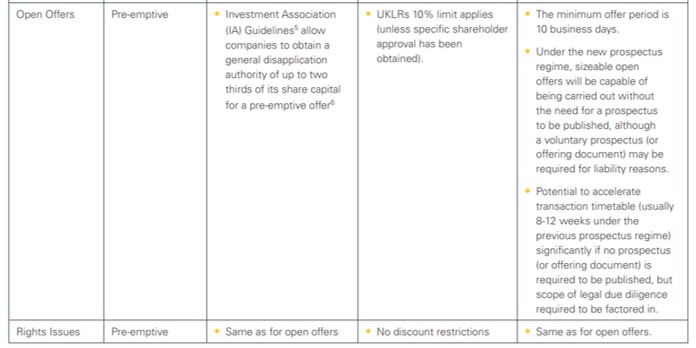

Listed companies will still need to adhere to the limits contained in their shareholder approvals in relation to the issuance of new shares and the disapplication of pre-emption rights.

If issuers are to make use of the higher threshold for when a prospectus needs to be published then, in the majority of cases, some form of pre-emptive offer structure (open offer or rights issue) will need to be used by them in light of 10 per cent +10 per cent limit on disapplication authorities included in the Pre-emption Group (PEG) Guidelines on the Disapplication of Pre-emption Rights (the PEG Guidelines) which listed companies are expected to follow. Companies that need to raise larger amounts of capital more frequently (so-called “capital hungry companies” under the PEG Guidelines) will be able to seek larger disapplication authorities from their shareholders provided that the reasoning for exceeding the above limits is specifically highlighted at the time that the request for a general disapplication is made. IPO candidates should disclose in their IPO prospectus if they intend to be a “capital hungry company.”

Implementing the admission of securities to a primary MTF exemption to the general prohibition on public offers under the new regime will facilitate the inclusion of larger retail offers on AIM fundraises. Historically, retail components on AIM fundraises (including pre-emptive ones) have had to be subject to the GBP equivalent of the previous €8 million cap (even when carried out pre-emptively, for example, in the case of an open offer), in order not to trigger the requirement of publishing a prospectus.

This will no longer be the case meaning that larger retail components could be carried out by AIM companies (both at IPO and subsequently) albeit in compliance with the relevant company’s allotment and disapplication of pre-emption right authorities (passed either at the company’s last annual general meeting or obtained specifically for the transaction at a general meeting).

It is also worth noting that that the changes being brought in by the FCA to the Market Conduct Handbook will allow issuers with securities already admitted to AIM to admit further classes of securities, whether they are fungible with those already admitted to trading, without having to publish a separate MTF admission prospectus. It will be interesting to see to what extent market practice develops to make use of this flexibility.

Footnotes to chart

4, The PEG Guidelines relate to issuances by companies listed in the Equity Shares Commercial Companies Category. AIM companies are also encouraged to adopt them. The PEG Guidelines also permit small additional increases of up to 2 per cent to these limits for concurrent retail raises.

5, The Investment Association Share Capital Management Guidelines (IA Guidelines).

6, N.B. IA Guidelines preference for rights issue for larger fundraises.