Art

The Art Market In 2020: UBS Basel Report

Virtually all market segments suffered declines last year, creating the biggest recession in the global art market since the 2008/9 financial crisis. But from adversity opportunity grows. Here are the main numbers.

Although overall sales fell 22 per cent for the year to $50 billion and most market segments saw sharp declines, auction houses experimenting with digital offerings were the main saviours pushing online sales to a record high of $12.4 billion. This was double the previous year, and accounted for a quarter of total sales in 2020. In the absence of physical auctions, private sales were up by a third to $3.2 billion, and women in some of the leading markets were outspending men. These are some of the main findings of the annual Art Basel, UBS Global Art Market Report published today.

The report, authored by cultural economist Dr Clare McAndrew, is eagerly awaited for breakout trends and watched closely this year for market resilience and innovation as the industry has buffetted many challenges.

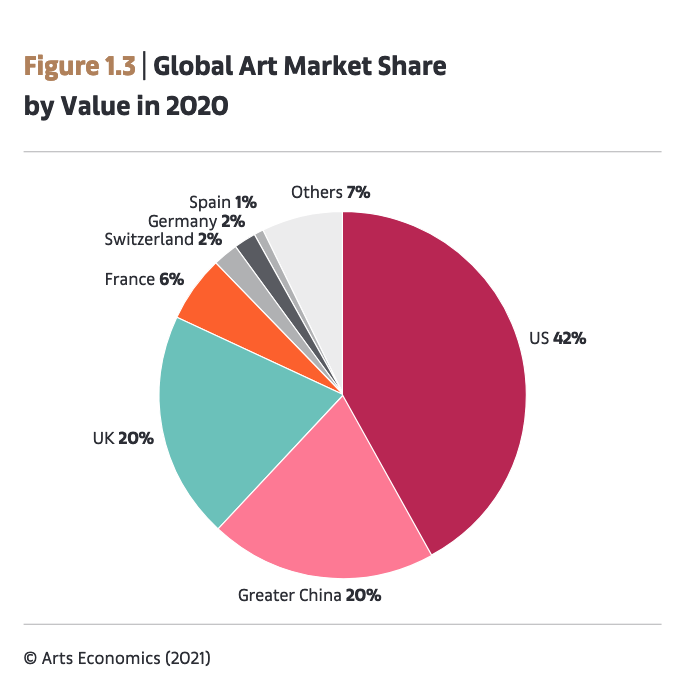

The US retained its prominence with 42 per cent of global sales but sales slumped 24 per cent for the year to $21.3 billion. Greater China and the UK own 20 per cent a piece of global sales; both these markets saw double-digit sales declines, with the UK recording its lowest revenues in a decade. China overtook the US last year to become the largest public auction market, with just over a third of the sales market. The chart below shows the regional share.

While the numbers were unequivocally grim, the year did mark "a transformative period of innovation, restructuring, and new consumer behaviours, especially online," Noah Horowitz, director for Americas at Art Basel said. All of this has the potential to "significantly redefine the art business in the coming period,” he said.

HNW purchasing behaviour

Useful data was also provided by the HNW Collector

Survey, a survey of around 2,500 high net worth collectors

across the US, the UK, France, Germany, Italy, Hong Kong, Taiwan,

Singapore, Mexico, and for the first time this year, Mainland

China.

Despite the challenges, two-thirds of the collectors surveyed felt the pandemic had increased their interest in collecting, and half of those in a significant way. The majority said they would remain active in the market in 2021, with 57 per cent planning to buy more works.

Also revealing was the increasing role Instagram is playing for wealthy collectors. Roughly a third said they had purchased art using the social platform in 2020. Gender became a feature, with the HNW data showing more female collectors coming into the fray and outspending men in influential markets such as the US, the UK, France and Mainland China.

Millennials, new power hitters

In many ways the last year has been defined by the behaviour of

Millennials. They are already well disposed to the digital art

marketplace and generally have a higher disposable income than

their digital Gen-Z cousins. UBS data reflects this showing that

HNW Millennials were the highest spenders in 2020, with 30 per

cent of them spending over $1 million on art, versus 17 per cent

for Boomers.

Even though art fairs did their best to move collections quickly online, the report said two-thirds of the usual fairs were cancelled in 2020. Even so, roughly half of HNWs said they had purchased at an online fair, enjoying the viewing room experience. They liked more transparency, more information about works and artists at their fingertips, and easier access to the curators and artists themselves.

But online bonhomie only goes so far. Most wealthy collectors (66 per cent) said they still preferred to attend a physical exhibition to view works for sale.

The highest average annual declines in the market were reported by dealers with a turnover greater than $5 million. The fallout from the health crisis saw dealer sales declining by 20 per cent to an estimated $29.3 billion in 2020, after rising by 2 per cent the year before. Most said they expected sales to either hold ground or slip further in 2021 based on economies not recovering much before the second half of the year.

.png)

Clare McAndrew, author of the report and founder of Arts Economics, said the fall in sales "was inevitable" as markets struggled with the realities of the COVID-19 pandemic. Many of the small businesses rely on discretionary purchases and being able to travel and benefit from the personal contact, she said. “But the crisis also provided the impetus for change and restructuring, the most fundamental shift being the rollout of digital strategies and online sales, which had lagged behind other industries up to now."

Earlier in the week, this service reported on the Christie’s digital sale breaking records as an example of where blockchain authentication and cryptocurrency enthusiasm is coming together in powerful new ways; and equally, how the European market is facing more scrutiny from regulators over money laundering.

The US is similarly imposing more KYC rules on art sellers. At the beginning of this year, as part of the National Defense Authorization Act, the US Congress extended to the antiquities market the client disclosure requirements under the US Bank Secrecy Act. The same oversight is expected to extend to the entire US art market by next year.