Uncategorised

Share Option Plans - Trends in the FTSE 250

This is the fourth in a series of articles focusing on trends in the remuneration of directors of companies in the FTSE 250 (excluding inv...

This is the fourth in a series of articles focusing on trends

in the remuneration of directors of companies in the FTSE 250

(excluding investment trusts). Information is taken from annual

reports accounts published before 30 June 2005 and, in the case

of long-term incentive plans also includes information from

shareholder communications on new plans put forward for

approval at AGMs up until early July 2005.

In the last edition of Executive Compensation Briefing we

focused in more detail on deferred annual incentives. In

this article we have focused in more detail on share option

plans.

In future articles in this series we will focus in on other

forms of long term incentive plans and on non-executive

directors’ remuneration.

Standard Share Option Plans

The number of share option plans in place in FTSE 250 companies

continues to decrease. 29 FTSE 250 companies have

replaced the share option plan with an alternative form of long

term plan during the year, or will no longer use it for

executive directors.

75 per cent of FTSE 250 companies currently have share option

plans in place with only 48 per cent of FTSE 250 companies

regularly granting options to executive directors compared to

67 per cent of FTSE 250 companies in 2004 and 76 per cent in

2003.

The number of new share option plans being implemented has also

decreased with eight new plans in FTSE 250 companies introduced

during the year. This compares to 14 between July 2003

and July 2004 and 18 between July 2002 and July 2003.

The table below shows, as a percentage of the plans currently

in place, the year in which these plans were introduced.

Introduction of share option plans - % of plans currently in

place

|

|

FTSE 250

|

|

% of plans introduced prior to 1999

|

40%

|

|

% of plans introduced in 1999

|

8%

|

|

% of plans introduced in 2000

|

7%

|

|

% of plans introduced in 2001

|

10%

|

|

% of plans introduced in 2002

|

12%

|

|

% of plans introduced in 2003

|

8%

|

|

% of plans introduced in 2004

|

10%

|

|

% of plans introduced in 2005 to July

|

5%

|

There have been a higher number of plans amended between July 2004 and July 2005 than in previous years. Share option plans have been amended in 21 FTSE 250 companies compared to 20 between July 2002 and July 2003. However, it should be noted that many of these amendments are minor changes, such as an amendment to allow the use of treasury share, rather than a significant change in the plan design.

As indicated above, executive directors do not always

participate in the share option plan. In some companies the

directors may participate in other long term plans with the

share option plan being retained for positions below the

board. In other companies the executive directors may be

eligible to participate in the plan but will not be granted

options on a regular basis. The plan may be used for

recruitment purposes or in other specific circumstances.

The number of companies where executive directors are eligible

to receive awards under both share option plans and other long

term plans (including deferred bonus matching plans and

co-investment plans) in the same year, has also decreased.

Currently, this is the case in 31 per cent of FTSE 250

companies, compared to 37 per cent last year.

Even in these companies, in practice, awards will not always be

made under both plans in the same year to every director.

Around 17 per cent of executive directors in FTSE 250 companies

have been granted both options and long term incentive awards

in the past financial year. This compares with 15 per

cent last year.

In some of the companies where awards under both plans are made

in the same year, award levels will be scaled back. In

some cases there is an overall maximum that may be granted

under both plans, with companies retaining the flexibility to

grant different proportions under each plan.

There continues to be a focus on the key design features of

share option plans listed below and companies continue to

either amend existing plans in line with best practice

guidelines, or introduce new plans incorporating these

features.

Individual Grant Limits

· Annual grant limits

are now in place in 75 per cent of FTSE 250 companies.

Performance Conditions

· In 69 per cent of

plans in FTSE 250 companies performance is now measured over

the three years following the grant of the options, rather than

over a rolling three year period, compared to 60 per cent last

year and only 52 per cent the previous year. All of the

new plans introduced in the past year, where details are

disclosed, measure performance over the three year period from

grant.

· The number of plans

where there is no retesting of performance conditions has risen

from 45 per cent to 73 per cent in FTSE 250. None of the

new plans introduced over the past year allow re-testing.

Exercise of options

· There continues to be an

increase in the number of plans where the number of options

exercisable is based on the level of performance achieved,

rather than the traditional ‘all or nothing’ approach.

This is now the case in 54 per cent of the plans currently in

operation (where exercise is dependent on performance) in FTSE

250 companies. This compares to 47 per cent last year.

Current practice

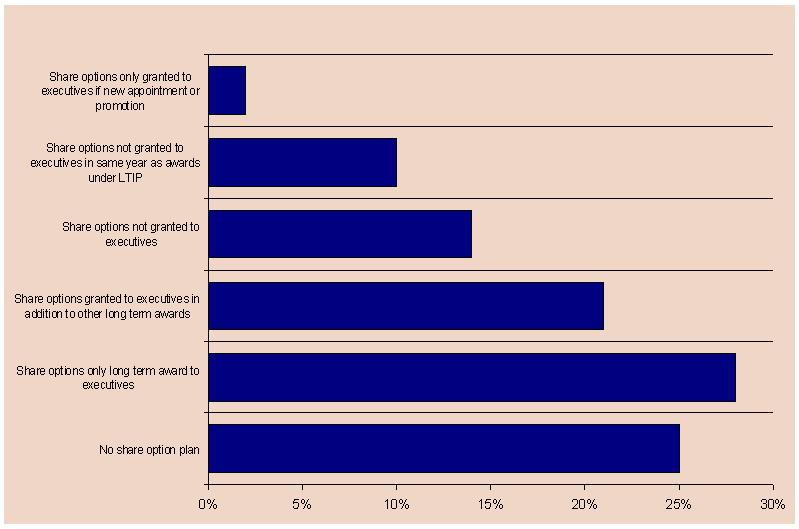

The following chart illustrates how plans are currently used.

Share option plans – current practice

Grant Policy

The majority of plans now incorporate an annual individual

limit. These limits are commonly expressed as a

percentage of salary although some express them as a percentage

of earnings or remuneration. The terms ‘earnings’ and

‘remuneration’ can typically be interpreted to include salary

and annual bonus. Other elements of remuneration will not

normally be included in the definition.

The following table shows the annual maximum limit expressed as

a percentage of salary. Where the limit is given as

earnings, the target annual bonus has been added to the salary

and the multiple of earnings then calculated as a percentage of

salary. Where the level of grant is calculated using an

option valuation methodology the equivalent face value of the

grant has been taken.

The table shows the ‘typical’ maximum award and the overall

annual limit. Almost 40 per cent of share option plans

have a higher limit which may be used in exceptional

circumstances.

It is worth noting that some companies have very highly geared

plans and the level of performance required for full vesting

may be significantly more stretching than in other plans.

Share option plans – annual grant limit (% of salary)

|

|

FTSE 250

|

|

|

|

Typical limit

|

Absolute limit

|

|

Upper decile

|

250%

|

400%

|

|

Upper quartile

|

200%

|

300%

|

|

Median

|

150%

|

200%

|

|

Lower quartile

|

100%

|

140%

|

|

Lower decile

|

100%

|

100%

|

Annual grant limits have not changed significantly since last

year.

Actual Award Levels in Last Financial Year

The information in the tables above is based on plan limits

rather than actual grants made to individuals. The

following table shows the range of grants made in the last

financial year as a percentage of salary for executive

directors, by market capitalisation. Although grants for the

top full-time executive tend to be slightly higher than for

other executive directors, the differences are not significant.

Interestingly, there is also little indication that option

grants are lower where performance shares have also been

awarded during the year other than in the very largest

companies.

Share option grant as % of basic salary by market

capitalisation

|

Market

capitalisation £m |

Q1

|

Median

|

Q3

|

Average

|

|

200 – 500

|

85%

|

104%

|

164%

|

162%

|

|

501 – 1,000

|

95%

|

103%

|

150%

|

127%

|

|

1,001 – 2,100

|

95%

|

163%

|

206%

|

162%

|

|

All

|

91%

|

119%

|

189%

|

151%

|

· 49 per cent

of all executive directors received a share option grant during

the year compared to 58 per cent last year.

· 16 per cent of

executive directors received both an option grant and a

performance share plan award during the year which is the same

percentage as last year.

· 27 per cent of all

executive directors did not receive either an option grant or

performance share award compared to 23 per cent last year.

Performance Conditions

|

|

Only 2 per cent of FTSE 250 companies do not require

performance targets to be met before the options become

exercisable, or before options are granted.

The number of plans which link the level of vesting to the

level of performance achieved continues to increase, in line

with investor guidelines which generally support this

practice. 54 per cent of plans which incorporate

performance measures in FTSE 250 companies use this method

compared to 47 per cent last year respectively. 80 per

cent of plans introduced in the past year incorporate scaled

vesting.

In almost three quarters of share option plans EPS is the main

performance measure, which is the same proportion as last year.

Where all options vest if the performance target is met there

has been an increase in the number of FTSE 250 companies using

EPS as the performance measure.

Where performance is based on TSR the requirement is usually

that TSR must be at least equal to the median of a comparator

group over a three year period for minimum vesting and

typically upper quartile performance will be required for full

vesting.

In all but one of the new plans introduced during the year EPS

is the sole performance measure. None of the new plans

use TSR as a measure of performance.

The following tables show the performance measures used in

plans where all the options vest if the performance target is

met and those where the vesting is scaled.

Share option plans – performance measures in plans where all

vest

|

|

FTSE 250

|

|

|

|

2005

|

2004

|

|

EPS growth at least equal to RPI

|

0%

|

0%

|

|

EPS growth equal to RPI + 2% pa or 6% over 3 years

|

13%

|

15%

|

|

EPS growth equal to RPI + 3% pa or 9% over 3 years

|

44%

|

36%

|

|

EPS growth equal to RPI + 4% pa or 12% over 3 years

|

3%

|

5%

|

|

Other EPS target

|

19%

|

13%

|

|

TSR above median of comparator group1

|

8%

|

10%

|

|

TSR and EPS

|

1%

|

3%

|

|

Share price

|

5%

|

4%

|

|

Other

|

5%

|

10%

|

|

No details

|

2%

|

4%

|

1 these companies may also have an EPS underpin

Share option plans – performance measures in plans with

scaled vesting

|

|

FTSE 250

|

|

|

|

2005

|

2004

|

|

EPS

|

74%

|

74%

|

|

TSR relative to comparator group

|

16%

|

18%

|

|

TSR and EPS

|

5%

|

2%

|

|

TSR and other

|

0%

|

0%

|

|

Other

|

5%

|

6%

|

|

No details

|

0%

|

0%

|

The chart below show the performance measures used in all

plans.

Share option plans – performance measures in FTSE 250

companies

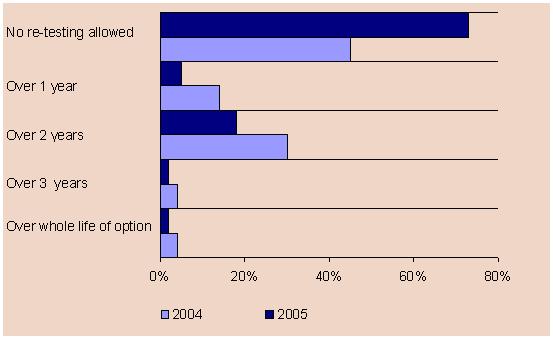

Fixed performance period and re-testing

The number of plans where performance is measured over a fixed

period from the date of grant continues to increase and all of

the new plans introduced over the past year follow investor

guidelines in this respect. Currently 69 per cent of

plans in FTSE 250 companies measure performance over a fixed

period compared to 60 per cent of plans last year and only 52

per cent two years ago. .

Shareholders continue to apply pressure on the issue of

re-testing and the number of plans where there is now no

re-testing has decreased significantly. We are aware of

at least 19 companies where the re-testing provision has been

removed during the year and new plans typically will not

include re-testing provisions.

Where re-testing is allowed, this will typically be over a

further one or two years, although there a small number of FTSE

250 companies allowing re-testing over a longer period and in

some cases over the whole life of the option. None of the

new plans introduced in the past year allow re-testing.

The probability of full vesting is significantly reduced where

re-testing is from a fixed base date.

The following charts show how many years’ performance may be

re-tested over before the options lapse. Within FTSE 250

companies there has been a significant increase in the number

of plans where no re-testing is allowed, from 45 per cent last

year to 73 per cent this year.

Phantom Option Plans/ SARs

Phantom option plans, or share appreciation rights, are plans

which pay a cash award related to the increase in share price

from the commencement of the plan to the exercise date of the

notional share option.

Companies use phantom options where conventional share options

are not appropriate, such as for overseas executives or where

dilution limits would be exceeded if more share options were to

be granted. Phantom option plans may also be more

appropriate for business units or divisions, where the phantom

share price is based on the notional value of the entity, and

not the group.

These plans are uncommon in FTSE 250 companies and there has

been no change in the number of companies operating such plans

over the past year. In general these plans are used in

one-off situations such as recruitment, or for non-UK

directors.

Where these plans exist they tend to operate in a very similar

way to standard option plans in terms of performance conditions

and exercise periods.

Equity-settled SARs

Equity-settled share appreciation rights allow the exercise of

an option to be satisfied by delivering shares with a market

value equivalent to the option gain. They are therefore

less dilutive than option awards but deliver the same gain. Now

that the P&L cost and corporate tax treatment is the same

as for option awards and the ABI has clarified its position on

equity-settled share appreciation rights we expect to see an

increase in the number of companies amending share option plans

to facilitate equity-settled SARs.

Conclusion

The trend from option plans to performance share plans is

continuing. However it is rarely clear whether this is

driven by the introduction of IFRS 2/FRS 20, the view that

share prices will not rise much in the next few years, the

apparent preference of some Institutional Investors for

performance share plans or that some people simply believe that

performance share plans are just “better”.

What is clear though is that, just like in 1995 following the

publication of the Greenbury Report, share option plans

continue to have their place in a significant number of

companies. For many of these companies that now also

operate performance share plans, participation in the option

plan is limited to employees below the main board (and in many

cases the next tier of senior executives).

What remains critical for companies reviewing their incentive

plans is that they give proper consideration as to whether to

continue with or even introduce a share option plan and the

basis on which such a plan should operate.