Investment Strategies

GUEST COMMENT: Demand Shift - Japan Has A New Marginal Buyer For Equities

A significant move by a huge Japanese state pension scheme, the world's largest, towards equities signals rising optimism about that asset class.

There continues to be debate on whether the reflationary and “supply-side” reforms in Japan will work and take the Asian country out of a period of slow growth that has gone on for more than two decades. The author of this article, Julia Scheufler, of Cerno Capital, argues that a major move by Japan’s state pension scheme is very positive for equities and will excite global as well as domestic investors. This article is reprinted with permission; the editors of this publication don’t necessarily agree with all the comments expressed but are grateful to be able to share these insights, and invite readers to respond.

Last year, the Japanese Government Pension Investment Fund (GPIF) announced its intention to cut allocations to low yielding government bonds and to double its exposure to domestic equities.

The logical pretext for this decision is the need to achieve higher returns to cover increasing pension payments to the country’s ageing population. After decades of overweighting bonds - which benefitted from Japan’s deflationary environment - policy changes by Prime Minister Abe, set out to boost risk assets and to introduce inflation, gave this move further urgency.

The new asset allocation came into effect on 31 October

2014.

Source: BCA Research, GPIF

Data from BCA Research shows that the world’s largest pension fund, with total investable assets of Y138 trillion ($1.14 trillion), has shifted close to $90 billion into domestic equities in the fourth quarter of 2014 - still 5 per cent ($59 billion) below its new target allocation of 25 per cent. A further three Japanese public pension funds, managing assets in the region of $250 billion, are expected to follow suit this year. An estimated 13 per cent increase to their allocation would add a further $33 billion in net new allocation to the domestic stock market. Other government-run funds are likely to fall in line as well.

As James Spence has pointed out in his written pieces, we are witnessing the workings of a consensus culture. More money will be chasing Japanese equities, pushing up prices and refocusing international attention on corporate Japan. This new demand is one of the reasons why we have recently seen a divergence of economic data and equity market returns.

Foreign investors reduced their equity allocations to Japan, particularly in the first half of last year, due to deteriorating economic data and lessened confidence in Abe’s ability to reverse this trend. A portion of the foreign investor set, hedge funds in particular, are low conviction investors and twitchy with it. However, domestic investors have emerged as the new marginal buyers with the government pension fund at the vanguard. They are investing the majority of assets, earmarked for domestic equities, into passive vehicles tracking the TOPIX index, the JPX Nikkei 400 and the MSCI Japan Index. The latter two are held in our TM Cerno Select fund.

These indices have returned over 18 per cent in local currency terms since 31 October 2014.

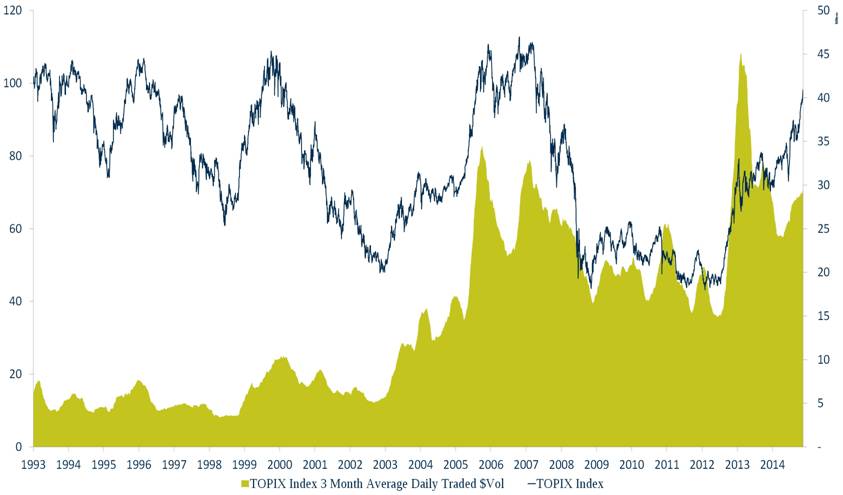

To assess the impact the GPIF had on the Japanese stockmarket, we looked at the average daily traded volume for the TOPIX index. Daily volumes spiked following Abe’s election in 2012 to an all-time high of $45 billion in the course of 2013. Trading volumes have since levelled off.

Trading levels bottomed in the second half of 2014 at $24 billion prior to the GPIF’s announcement to restructure its portfolios, but subsequently increased to today's level of $28 billion. GPIF’s intentions have been known since April and the new growth plan, implying changes to the asset allocation are necessary, was published in June 2014. The new asset allocation taking effect from 31 October 2014 coincided with a further QE announcement at the start of November - earlier than the market expected.

We conclude that whilst the monetary value of GPIF allocation shifts are not large enough to contribute to an increase in volume outright, the pickup since July 2014 appears to have turned the overriding sentiment of market participants positive again – influenced both by the public sector’s intention of refocusing portfolios to equities and by further QE.

TOPIX Index – 3 Month Average Daily Traded Volume.

We expect this net new buying trend to continue. In Japan, once a consensus is formed, it stays formed. We anticipate Japanese equities to benefit from new demand as well as from improvements in corporate governance and the increased focus on generating sustainable returns on equity.

Japanese equities continue to be priced attractively on an absolute and relative basis.