Wealth Strategies

Finding Opportunities Amid Trump’s Tariff Shock Therapy

US tariffs have been imposed, although there is still much uncertainty about what will happen in coming weeks. Based on the assumption that some tariffs will endure, what should investors think, and what opportunities arise? Australia-headquartered Antipodes Partners offers its ideas.

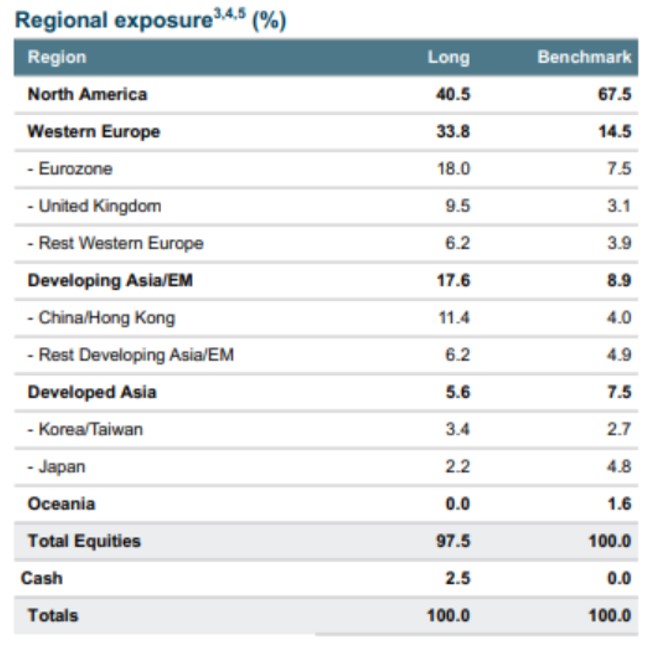

The following article asks the question as to where might investors find money-making opportunities amidst the disruption caused by US tariffs, as announced on 2 April by President Donald Trump. Leaving aside the wisdom or otherwise of tariffs, what should allocators of capital – such as wealth managers – do now? To consider this is Alison Savas (main photo), investment director at Antipodes Partners. (As its name suggests, it is headquartered in Australia; it also has offices in London and New Zealand.) We include a chart showing the firm’s own asset allocation positions.

The editors welcome the chance to contribute guest writers’ ideas into the arena of debate and discussion; the usual editorial disclaimers apply to views of outside contributors. To comment, email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

Tangible panic in credit markets last week saw Trump issue a

90-day pause on reciprocal tariffs. This leaves us with a 10 per

cent universal tariff coupled with a massive 125 per cent tariff

on China.

While Trump may have stepped back from the edge, these numbers still imply a weighted average tariff of 25 per cent. Our view remains that the final act is still yet to be written. Tariff ping pong between the US and China continues with both Presidents Trump and Xi indicating that they are unwilling to back down, though one suspects a deal can be made such that both can claim victory. Failing that, it's hard to see how a global recession can be avoided. How Europe responds is also critical. If the bloc chooses to extend the existing Digital Services Tax, it will be very damaging to the US mega cap tech stocks.

Most North American trade is in intermediate goods, heightening the risk of supply chain disruptions as well as the risk of upward pressure on inflation on top of lower economic growth. A weaker currency in the face of tariffs will also feed into inflation more so than what was experienced during the first round of Trump tariffs in 2017 where the dollar remained stronger.

Estimates suggest that, all else being equal, a circa 25 per

cent tariff could add almost 2 per cent to core PCE inflation

(which is currently running at 2.8 per cent). Business and

consumer confidence will continue to remain weak while

uncertainty around tariffs and the unpredictability of the Trump

administration continues. Add in the extent of potential DOGE

spending cuts, which could see a significant tightening in fiscal

policy in the US, and uncertainty and pressure on growth ratchets

higher again. The risk remains that Trump’s shock therapy

approach to re-industrialisation is just too much for the US or

global economy to bear and the US stumbles into stagflation.

Despite this, the starting multiple of US equities today is still

21x earnings, and tariffs are yet to be factored into bottom-up

forecasts. Asset prices will not only be impacted by

EPS downgrades but also a higher discount rate will

inevitably be applied to compensate for Trump irrationality. We

have seen this playbook before in China where policy became

unpredictable with President Xi's “Common Prosperity” programme.

While policy uncertainty is widening in the US, it is arguably narrowing in Europe and China. Net exports to the US account for circa 2.5 per cent of Germany and China's GDP – at least some of this will be offset by fiscal stimulus. Further, the US accounts for only 6 per cent of China's total imports. Germany's announcements on defence and security and its €500 billion ($567 billion) infrastructure fund equates to a total fiscal boost of 3 per cent of GDP per annum. and could see an additional 2 per cent per annum to GDP growth. China hasn't made the same definitive announcements, but the direction of travel is very clear.

The very wide range of outcomes means that there will be opportunities for active managers to take advantage of market distortions. We began to position our funds more defensively from the middle of February and, given the degree of policy uncertainty, it makes sense to continue to lean defensively – but we do see pockets of opportunity. One of the largest holdings in our portfolio is Barrick Gold. We think the gold price can be resilient in a hard or soft landing, with demand underwritten by central banks diversifying away from dollar-denominated assets. If the economic outlook weakens, we expect retail will come back to gold, having drawn down their holdings over the last three years. At the current spot price, Barrick is still priced on a sub 10x multiple with volumes expected to accelerate as production ramps back up.

We've been buying utilities in Western Europe, high quality consumer exposures in China that will be stimulus beneficiaries (such as China Resources Beer), and we think LATAM could emerge as a relative winner. Mexico is firmly at the negotiating table, and the reality is that low end manufacturing isn't going to come back to the US – but it could come to Mexico or South America.

And Brazil is one of the very few countries out of the firing line as the US has a trade surplus with Brazil. Further, if we see a repeat of 2017, China can shift demand for agricultural products from the US to Brazil, giving further support to its domestic economy.

It is possible that the unintended consequences of Trump's policies could make “The Rest of the World Great Again.”

If conviction increases that the growth shock is real, we will

continue to lean into the defensive allocations in our portfolio.

But we don't want to get too bearish. The Fed can reverse QT,

there will be some stimulus out of the US as tariff revenue is

recycled into tax cuts, and we will see stimulus out of Europe

and China.

Given such extreme policy uncertainty investors must be thinking

about tail risk protection in their portfolio to protect against

unexpected drawdowns. More broadly speaking, we think the days of

US mega-cap exceptionalism are waning. The market can continue to

broaden via regional shifts, driven by this change in fiscal

impulse, and sector and style shifts driven by the

democratisation of AI and a broad infrastructure-led investment

cycle.

Note:

The Antipodes Global Long Fund is currently underweight to US

equities and overweight towards Europe and emerging markets. As

bottom-up stock pickers, our positioning is premised on our

industry views and company-level analysis, seeking out businesses

that are mispriced relative to their resilience and growth

potential, as opposed to the overall outlook for the

regions.

Source: Antipodes Partners