Strategy

Exclusive: WBA’s Editor Takes Financial Personality Exam… Yielding Surprising Results

Tara Loader Wilkinson reveals her deepest darkest investment hopes and fears, through Barclays Wealth psychometric financial personality assessment.

Many of WealthBriefingAsia’s readers do not have to dream about how they would invest $10 million. But for me, fantasising about living the life of a multi-millionaire is an all too common pastime.

Which is why when Barclays Wealth offered me the opportunity to take its psychometric financial personality assessment, which reveals how I should invest my (supposed) millions on the basis of my deepest darkest hopes and fears, I immediately accepted.

Little did I know that the test would turn up certain results about my personality that I was not even aware of myself: namely that I am ultra-conservative and ready to run for the hills at the slightest whiff of trouble. I am also a bit of a control freak. Who knew!?

The results

The test itself was straightforward - 36 multiple choice questions which took around five minutes to complete, carried out on the fictional basis of having $10 million to invest. Questions included "to what extent do you agree with the following statements: 'I am a financial risk taker', 'I get stressed easily', 'Investment managers are able to get better returns than the market average for their investors'." So far so good.

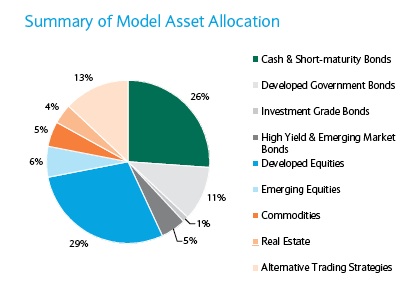

Half an hour later I received a proposal with a suggested portfolio containing nine different asset classes ranging from developed equities (27 per cent) to cash and short maturity bonds (19 per cent) to alternative trading strategies (13 per cent), see below.

Then I got a call from Peter Brooks, the recently-installed head of behavioural finance for the Asia business, based in Singapore. As delicately as possible, he walked me through the results.

“You score medium to low on risk appetite,” said Brooks. “This implies that while security of capital is important to you, your portfolio can have some allocation to riskier assets; you prefer a steadier lower growth rate than a higher more volatile one. A diversified portfolio is suitable for your risk tolerance,” he recommended. In other words, I am a bit of a wimp.

On composure, I was also medium-low, which reflects how anxious I get about short-term market fluctuations. My composure level shows I would make a highly skittish client. In other words, in today’s market, I am every private banker’s worst nightmare.

“You are more unsettled by short-term fluctuations in portfolio values than most people. Your low composure can be mitigated somewhat by the 'arm’s length' management by discretionary portfolio managers. You may also be uncomfortable with illiquid investments,” added Brooks.

My ostensibly nervous disposition was at odds with my desire for market engagement. On the market engagement scale I scored "high", meaning I am very willing to participate in the financial markets. “You recognize that by investing you put your wealth at risk at the level that is appropriate for your risk tolerance. You do not need to enter market in phases so can maximize time in the market,” added Brooks.

However, my gung-ho attitude to the markets did not sit well with my control-freakish tendencies – again, not the making of an ideal private banking client.

On delegation to a relationship manager, I scored low, meaning I like to maintain hands-on control of my investments. I would make the sort of client who is deeply mistrustful and on the phone two or three times a day, agreed Brooks, which sounded about right.

“You believe it may be possible for skilled managers to outperform but this skill may be hard to identify. You may want your investments to do more than simply track the market indices so you are open to investment approaches with proven track records. "

This matched my "belief in skill" ranking, which was moderate-high. “You might want a combination of actively and passively managed products. You may consider more frequent short-term tactical re-balancing,” said Brooks. He added that this was quite a common result for individuals who have some exposure to banking, like financial journalists.

But any bravado was washed away when I discovered that my perceived financial expertise is medium-low. This reflects my own comfort with current financial conditions - which admittedly, is fairly non-existent in the current environment. “It may be more suitable for you to use simple and transparent products or strategies,” advised Brooks. Exchange-traded funds and gold, it is then....

A unique approach

The spotlight has fallen on risk profiling in recent years as banks and independent financial advisers in their droves have been slapped with fines from regulatory bodies for not having warned customers properly about risky products – or not kept an adequate record of it. Those who have been named and shamed include Coutts & Co, JP Morgan, Credit Suisse and Barclays itself.

Most wealth managers have some form of risk profiling or other which they use to assign clients into one investment bracket or another. Many circulate questionnaires to new clients, a strategy which has received heavy criticism from the UK's Financial Services Authority. The FSA published a report calling for new guidelines on risk profiling and suitability practices, as many questionnaire results were considered misrepresentative of client risk appetite.

Barclays Wealth prides itself on its behavioural finance testing, which, it believes, sets it apart from most other wealth advisors. A relatively new field of research, behavioural finance uses psychology to understand why investors make the financial decisions they do, and how these individual decisions combine to drive markets. This type of risk profiling can identify 'cognitive biases' - common traps which investors can fall into when making decisions. Barclays Wealth’s team of behavioural finance experts includes members with PhDs in behavioural decision theory and experimental economics.

Behavioural finance has up until very recently been on the "lunatic fringe" of many economics departments, and Barclays Wealth only adopted it about two years ago. One of the criticisms of the discipline is that it is good at showing how people make bad decisions, but does not offer much advice on how to make better decisions.

But with risk profiling and suitability practices the current hot potato in the world of wealth management, Barclays Wealth says using the behavioural finance technique is one of the best decisions it ever made.

"Using behavioural finance at Barclays Wealth has been very successful. Not only do we help clients recognise some of the dangers that lurk in their financial decisions, we also help them make better decisions. The market turmoil of the 2008-9 banking crisis and then the 2011 sovereign debt crisis have only underlined the importance of understanding the emotional elements of investing. Our behavioural finance approach puts the tools in the hands of our bankers to really engage with their clients differently and help counsel them through the tough times as well as identify the strategies for the good times," said Brooks.

"One of the strengths of the financial personality assessment is that it allows us to identify contradictions and have an open discussion with the client about some of the trade-offs they may need to make. It is always insightful to explore some of these potential contradictions with clients and help them realise that sometimes their own personality can work against them," he added.