Family Office

EXCLUSIVE INTERVIEW: Entitled Brats, Contributing Leaders And Families

This publication recently interviewed a family advisor and author who feels that the entitlement mentality he sees in many wealthy families is a major problem that needs to be challenged.

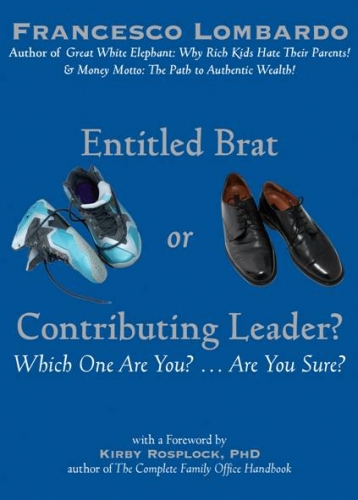

The business of transferring wealth from one generation to another – hopefully successfully – is a constant theme in these pages. And rightly so – there are too many horror stories of where the inheriting group ends up frittering away its money. The saying “shirtsleeves to shirtsleeves in three generations” is well known. A large part of the problem is that inheritance, financial transfer and money management is not just about hard financial data. There are emotional issues at work. And this is where Francesco Lombardo, who runs the business Veritage – based in Vancouver, Canada – comes in. Lombardo flies around the world advising wealthy families about what he calls the problems of an entitlement mentality that he sees in many would-be and actual inheritors. He has a book out: Entitled Brat or Contributing Leader - Which one are you….are you sure? The book is a concise exploration of such issues. And Lombardo spoke to this publication during one of his trips to say what the book is about and what his business aims to do. His book is launched in London on 15 October.

Francesco Lombardo was born in Vanderhoof in north western British Columbia. His father was a mining engineer and as a result the family moved and resided in numerous places. They lived in Perth, Durban, Monrovia, Buenos Aires, Rio Dè Jenerio and finally settled back in British Columbia where he completed high school and later attended University.

His original studies where guiding him to become a medical doctor, but when his father got ill and died he decided to drop out of university and seek a higher education and moved to Whistler where he tended bar and waited tables. One day as he was hitchhiking for a ride he got picked up by an old friend whom told Lombardo he was managing money for clients in Vancouver. This intrigued Lombardo and ultimately motivated him to go back to school and become an investment advisor. He built his practice over the next seventeen years into a $150 million book of business managing money for 90 families. In June of 2008 after having written two books, Life after Wealth, and Money Motto, he decided to follow his passion. Lombardo sold his book of business and his shares in the investment management firm he help build and Veritage Family Office was born.

He has written two more books, both of which deal with topics he says most shy away from: Great White Elephant, Why Rich Kids Hate their Parents and his latest Entitled Brat or Contributing Leader.

Why did you create Veritage?

I witnessed my clients in the wealth management practice were

always asking when is enough, enough - what is the number? They

were not sure on how to talk to their children about the money

they had accumulated. They had no idea how to even start the

conversation. I saw them struggle with “how do I prepare my

children to inherit the wealth I have spent a lifetime either

building or being the steward of?” When we would ask our

clients how they were preparing their kids, they would usually

refer to educating the kids on the technical matters of wealth,

how to invest, what is a stock or bond.

What I realized was missing was the emotional education of money

and wealth - the why one does what he or she does with money and

wealth. So, I developed and created The Money Motto concept. Our

Money Motto is our subconscious belief about money and wealth.

This Money Motto is going to influence most of the decisions one

makes with money, from how to invest it, spend it, transition it

and of course inherit it. My own Money Motto used to be (because

it can change into one that serves us) that money allows me to

fit in. This belief came from when I was bullied as a child, and

I developed the belief that I did not fit in or did not belong.

So, in my twenties, I made a subconscious decision that if I make

a lot of money, I will buy my way in and fit it. As I look back

now I see this was the driver for starting my investment

management business and firm.

What is the business philosophy?

Veritage's philosophy is really simple. You cannot build

structure around dysfunction. Dysfunction is anything that a

family has not addressed. We call them Great White Elephants. We

do three things exceptionally well at Veritage and this is what

make us unique in the global marketplace: Uncover and understand

how their individual Money Mottos impact their relationships with

themselves and within the family system and its dynamics (because

how one treats their money is exactly how one treats their

relationships); design the individual and ultimately the Family

Money Purpose, which is their emotional objective and connection

for their wealth. This is the foundation of the vision/mission of

what the family wants their wealth to achieve in unison with the

family values, and third, develop strategy to emotionally prepare

the next generation for the transition to wealth so they may

become responsible stewards of the assets and values.

What are other wealth management players

doing?

I believe the wealth management industry is partly on the right

track. They have developed education for the next generation, but

the focus has been on the technical, qualitative components of

wealth, the how. What has been missing in my opinion is the

emotional component of wealth management, the why. The other more

pressing issue that I have witnessed for the most part, is

advisors are not addressing the Great White Elephant

conversations with their families. The advisor knows and sees the

issues or challenges in the family or family dynamics, yet says

nothing. In my opinion there are two reasons why this is not

happening. The first reason is most advisors don’t know how to

even start to have the conversation and secondly they are afraid

they might upset or get their client angry which may result in

the client firing the advisor.

Where are your clients from? Any trends?

Our clients currently come from North America and Europe. We are

looking to expand and work with Middle Eastern families and Asian

families. I believe the issues we address and transform are human

issues, not cultural issues. We all have beliefs and feelings,

hence we all have a Money Motto. As human beings we all feel

fear, entitlement, and isolation for being different or not

fitting in. Our mission at Veritage Family Office is to heal

families.

What sort of things do clients seek?

Clients are typically looking to find harmony within the family

and bring peace back. Regardless of how upset or angry family

members may be with each other, at the end of the day they love

one another. Most of the times their beliefs, either of

themselves or others, get in the way of having meaningful,

transparent authentic relationships. We assist our families in

developing the courage to be vulnerable with themselves and with

each other. The issues we get confronted with are entitlement

within the next generation, in the traditional sense or sometimes

with the older generation, not letting go of control or trusting

the next generation enough to run and manage the business or

wealth.

We also get confronted with how do I as a founder pick and develop the next leader for the business. We deal with unforgiveness for one another. We often get asked to assist with identification and later the development of the purpose for the wealth. We have made it, now what. We craft their money purpose. And finally we assist the parents or grandparents to emotionally equip the next generation to be emotionally prepared to handle the wealth. Our model is based on coaching and empowering our families towards vulnerability and becoming contributing leaders within themselves as individuals and with each other.

Clients usually hear about me from their advisors, typically private bankers, investment management advisors, accountants and friends. I speak at family business centres, family offices and other conferences globally and as a result often get approached by either a family member or trusted advisor to the family. Also my books which are sold through our website will often lead to client engagements.

European potential?

I see Europe and London as a base for it, as the biggest

potential for my type of business. This is due to the fact that

people are curious about understanding and uncovering their own

Money Motto, and the impact such has on their relationships. To

my knowledge there is no other firm that does what we do.

Also, European families are students of family business and the

impact family has on the business. In Europe as opposed to North

America, the family is the most important thing, not business,

hence they will invest in addressing and dealing with familial

matters.

Tell us a bit more about your new book

The latest book Entitled Brat or Contributing Leader, which one

are you….are you sure, looks at entitlement from a different

perspective. The thesis is that we all at some point feel

entitled to our beliefs, behaviours, thoughts, judgement and

prejudices. And, when we operate from this point of view, we

devolve into what I call an Entitled Brat. In the book I share my

journey from being an Entitled Brat and how I was able to

identify where the entitlement came from, the impact this had on

my relationships, and what I did to transform it to ultimately

become a Contributing Leader. The book assists the reader to

uncover their Entitled Brat and examine the impact this has on

relationships and offers practical tools to transform them (both

the older and younger generation) into Contributing Leaders. In

the book we share the characteristics of both the Entitled Brat

and Contributing Leader.

What have reactions to the book been like?

The wider reaction to my work is that it has been fairly

well received from the wealth management industry. Some folks

want to learn more and assist their clients, others as mentioned

earlier are afraid to address these issues so they choose to

ignore them. My vision is to transform the wealth management

industry globally. The reason is we as an industry only have a

30% success rate of transition of family owned business from the

1st generation to the 2nd, a 28 per cent of the 30 per cent from

2nd generation to 3rd generations, and only 12 per cent of the

3rd generation to 4th Generations. Considering that almost 65 per

cent of the global GDP is derived from business owning families,

this is a massive responsibility. I am looking for like-minded

professionals to assist me with changing the results. For that,

they need to be courageous and vulnerable with their families, by

leading by example.

How serious is what you call the “entitlement”

problem?

I believe “entitlement” is the next global epidemic we are facing

as a society. If one pays attention it is everywhere, from our

schools, universities, in business, on the roads, at airports, in

the tube, in our families and worst of all in every single one of

us. At some level we have all contributed to a global sense of

entitlement and have been affected by it as well. It is time we

faced entitlement for what it is, our own fears and insecurities

and stepped up to being the contributing leaders we were born to

be. Entitlement is not a soft issue. It is poison and it is

slowly killing all of us.

The value added proposing of what I am doing is transforming

first the families we serve, because they are letting go of their

own personal sense of entitlement in developing and maintaining

deep, transparent, vulnerable safe relationships with each other

and the family as a whole. They are healing. The second is

empowering advisors to step up into having the courage to bring

up the Great White Elephant conversations and issues with their

clients. We are transforming the world from entitlement to

contribution by leading by example.

How do you know your advice is successful?

How we track our results is in our families having more

authentic, vulnerable conversations with each other. We have

assisted them in developing and maintaining a personal code of

conduct on how they address and communicate with each other. This

empowers them to deal with conflict in a more efficient and less

confrontational way. Our families feel safer to communicate with

each other and have a deeper understanding of each other from

their Money Mottos and a greater sense of personal and familial

purpose from their Money Purpose.

My main ambition is to change the wealth and succession management industry. This is achieved in my opinion by both the families' and advisors' willingness to discuss and address and deal with their Great White Elephants, the biggest one being entitlement. It is about finding the courage to become contributing leaders. Success looks like we transform our society from one of entitlement to one of contribution with all of us leading by example.