Strategy

Differentiation: What Marketing Brochures Reveal About Strategy

Private banks speak more about themselves than they do about their clients.

Private banks speak more about themselves than they do about their clients. More importantly though, private banks hardly differentiate and they tend to use the same language: these are some of the findings of a study we conducted based on a quantitative analysis of the marketing brochures of 10 private banks*.

One might argue this as a pure communication issue. However, it goes much deeper. In fact, marketing brochures are a formidable proxy and they reveal much about a bank’s client strategy. They reflect what a bank really stands for and what it aims to offer in terms of services.

Analysing their content uncovers how a bank positions itself in the market and how it differentiates, or, how it does not differentiate.

For example, let us have a look at the best way not to differentiate.

All the banks we analysed (1) emphasise traditional soft values such as commitment, discretion, honesty, or stability and (2) highlight their prestige by using words like achievements, awards, leading or reputation. Hence, emphasising traditional soft values or prestige does not help to stand out at all.

Our findings were obtained based on a statistical discourse analysis tool, which combines ten soft criteria, such as prestige, independence or personalisation and 13 product and service categories, such as active advisory, mutual funds, alternative investments or family office.

There are three key insights that executives can gain from this research on positioning and differentiation.

1 Communications Styles. The banks in our sample use three different communication styles: prestige-oriented, process-oriented and performance-oriented. Interestingly, a third of the analysed institutions do not refer to investment performance at all and only one, Geneva-based Syz Bank, really emphasises it.

2 Us & You. A majority of banks in the sample communicate from an institution perspective rather than from a client perspective. Only a third of the analysed banks take a client perspective and address clients in a direct form with you and your.

3 Claiming Excellence. All analysed banks claim to be leading institutions and extensively use adjectives and superlatives such as best, award-winning, leading, renowned or superior. As a consequence, using superlatives has an insignificant impact on differentiation.

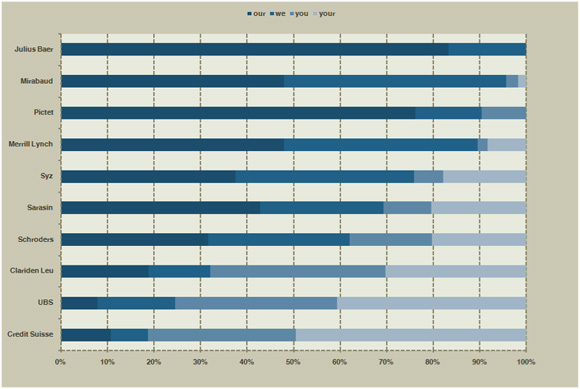

One insight that can be presented very nicely visually is how strongly some banks actually take a client perspective in their marketing brochures. Below you can see how many times an institution uses the terms our and we versus the number of times it uses you and your.

figure 1: our/we vs. you/your

This becomes even more striking when you look at the content of a marketing brochure through a visual method called tag-clouding. Tag clouds give a visual sense for the content of a document by emphasising frequent words through larger fonts and infrequent words through small fonts. Compare the tag-clouds for the two Swiss banks Credit Suisse and Mirabaud.

|

|

| figure 2: tag cloud for Credit Suisse |

|

|

| figure 3: tag cloud for Mirabaud |

While the outlined research shows that banks are very similar in

many aspects, it also points to some steps towards

differentiation. Geneva-based Mirabaud, for example, highlights

its top management throughout their marketing brochure and gives

its services a human touch by simulating interviews with key

people of their bank.

Syz Bank puts performance and alternative investments at the centre of their differentiation efforts. UBS and Credit Suisse give (advisory) processes and the client perspective a privileged place and emphasise customised solutions.

Surprisingly, products and services were used relatively little to achieve differentiation. Art banking, real estate or global custody services, though very niche oriented, offer some opportunities in terms of differentiation. But a real differentiation strategy cannot be established solely on the basis of these niches.

We believe there are significant opportunities to stand out for banks that dare to take new and bolder communication approaches. Gaining additional market in times of increasing competition is at stake.

* Analysed institutions were: Clariden Leu, Credit

Suisse, Julius Bär, Merrill Lynch (Suisse), Mirabaud, Pictet,

Sarasin, Schroders, Syz, UBS.