Statistics

Davos Tycoons' Wealth Mostly Higher After Financial Crisis - Report

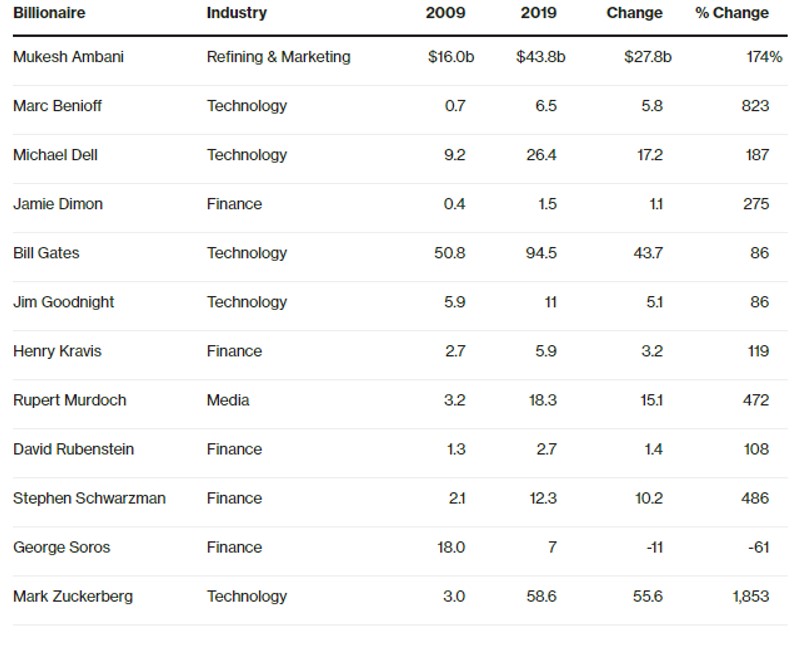

Data from the news and information service shows that with one exception (caused by a calculation change) all of the Davos attendees in its top-wealth list have got richer over the past 10 years.

Asia’s richest man, refining and marketing business tycoon Mukesh Ambani, has enjoyed a 174 per cent jump in his wealth since the post-crisis year of 2009, according to data tracking the prominent guests at the annual meeting of business leaders, politicians and thought leaders in Davos, Switzerland.

Ambani is the only Asian business leader cited in a list of such Davos attendees by Bloomberg in its data presentation on their wealth. Other guests at the conference are familiar names from the worlds of tech and financial services such as Microsoft’s Bill Gates, JP Morgan’s Jamie Dimon, hedge fund chief and activist George Soros, Facebook founder Mark Zuckerberg and private equity rainmaker Henry Kravis. (Figures on their wealth are given as of 17 January this year.)

Not all of those mentioned in the newswire’s data have enjoyed a rise in wealth. In Soros’ case, his net worth fell from 2009’s level because he switched about $18 billion to his Open Society foundations; these assets are excluded from how much he is privately worth.

To put the data below in context, recent figures from UBS and Pricewaterhouse (see a report by this news service here) showed that around the world, the wealth of billionaires rose to $8.9 billion in 2017 from $3.4 billion in 2009.

Source: Bloomberg Billionaires Index. From Bloomberg, 21 January, 2019.

The Davos conference takes place against an unsettled background: decelerating Chinese economic growth, worries about rising protectionism, a partial return to interest rate "normalisation" and the looming exit of the UK from the European Union.