Client Affairs

China "Bytes" Back: The Case For Equities - Comment

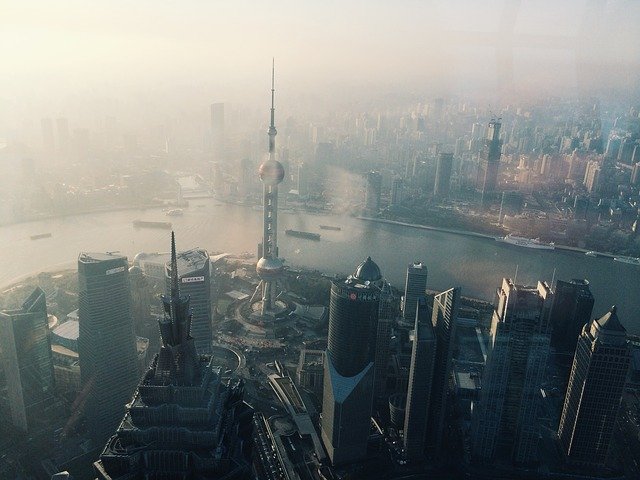

Much of what is fuelling deteriorating US-China relations is business dominance. China is rapidly closing the gap on per capita GDP - it has tech firms rivalling those in Silicon Valley, and an enviable domestic consumer market. Here Lombard Odier's Asia portfolio manager plots the course for Chinese equities and where broader reforms are taking shape.

Separate for a moment China’s economy from current geo-political antagonisms and it presents a number of market opportunities. For one it has a similar exposure to high-growth potential as US equities in areas such as e-commerce, telecoms and technology. China has been matching the US in tech prowess for some time, which has broadly been seen in executive orders signed by Donald Trump last week targeting China’s ByteDance (creator of TikTok), and more notably WeChat, the ubiquitous messaging and payments app owned by China’s second largest technology group Tencent.

To discuss the market, Lombard Odier’s senior portfolio manager and head of Asia, Zhikai Chen, outlines five aspects of the Chinese economy which are likely to unleash the most potential for investors. We welcome market perspectives, with the usual editorial disclaimers, and ask for your feedback to be sent to tom.burroughes@wealthbriefing.com or jackie.bennion@clearviewpublishing.com .

China is the engine of the global economy and has promising capacity for further growth, creating potential opportunities for discerning investors. It is the world’s second largest economy and has embarked on a series of structural reforms designed to strengthen its position on the global stage and transform it into a service-oriented and technology-driven giant.

We believe that there are five core elements of the China economy which will form a solid basis for China equities to thrive in the coming years.

China is relentlessly catching up and the quality of

growth is improving

The economy of China is a dominant global force. There is growing

evidence that Chinese authorities are also making promising

progress on improving the material well-being of its citizens,

which has a number of positive implications for investors.

Among developed economies, China is rapidly closing the gap on a GDP per capita basis too, which reflects the growing effectiveness of consumers' spending power. China’s per capita GDP exceeded $10,000 for the first time in 2019, according to the National Bureau of Statistics. This would indicate that the overall consumption level has the potential to grow further.

Importantly, China’s GDP per capita basis still lags that of the US and EU, for example, demonstrating the extent to which it has the capacity to grow.

China alone accounts for almost 20 per cent of the entire global Gross Domestic Product (GDP) and, while the economy has suffered as a consequence of the COVID-19 pandemic, the outlook remains promising. The Chinese government announced earlier this year that it would not be setting a growth target for 2020, but this presents an opportunity for the country to focus more sharply on the quality of growth.

The Organisation for Economic Co-operation and Development (OECD) recently noted that this decision to abandon a growth target for 2020 removes the incentive for growth at any cost and instead has the potential to put the economy on a more sustainable trajectory.

This focus on the quality of growth is increasing. For instance, the People’s Bank of China (PBoC) and six other agencies have developed 14 recommendations in favour of a “greener” financial system, with specialised investment institutions and supportive fiscal policies. Although it is worth noting that China today is home to 25 per cent of the world’s clean energy investment.

China’s economy is diversifying

China continues to transition from a manufacturing-heavy economic

model to one that is services and consumption-led. Annual job

creation has been driven almost exclusively by services since

2015, supported by a growing educated workforce.

Consumption remains the largest driver of growth in China and accounted for nearly 60 per cent of GDP growth in 2019. Consumption-driven growth is generally viewed as more sustainable because capacity adjusts to demand from the bottom up, as opposed to mandates from the top down.

In 2019, total retail sales of consumer goods were up by 8 per cent, year-on-year, accompanied by a growing share of online sales. McKinsey estimates that China’s online retail sales volume hit $1.5 trillion in 2019, representing a quarter of the country’s total retail sales volume. It also currently leads the world on mobile payment penetration.

China has taken proactive measures to accelerate consumption-led growth through a number of stimulus measures and tax cuts. China introduced reductions in value-added tax (VAT), postal tax, and individual income tax (IIT) in 2019 in order to spur consumer demand and shield against the threat of international trade tensions, most notably with the US. China also unveiled a two-year stimulus plan in 2019 designed to boost sales of consumer goods.

The growth of the country’s tertiary industry looks as though it will continue and there is significant capacity remaining, given how far as a share of GDP tertiary is behind the US, for example.

China as a tech-driven giant

China now has the second highest rate of investment in research

and development worldwide. The country is already cementing its

position as the world’s leading tech giant.

China has increased the amount it dedicates to R&D spending from 0.9 per cent in 2000 to 2 per cent of GDP in 2019. There is considerable room to grow this allocation, especially given the ‘Made in China 2025 strategy’ which has a strong emphasis on technological innovation.

The country is also in a good position to develop its technology sector. More than 800 million people are internet users – representing 60 per cent of its total population. Comparatively, the US estimates that it has 293 million internet users. Proportionally, the US has a higher concentration of users, since the 293 million figure represents 89 per cent of its total population. But this reflects the capacity China has spare on this front, which is a positive sign. China also has 817 million mobile internet users and 583 million mobile payment users.

Today, China is host to eight of the world’s 20 largest internet companies – narrowly behind the US with 12. In terms of start-up investment, it ranks second only to the US. We believe that China will continue as a tech-driven giant, especially in light of top-level commitments to stay at the forefront of technological advancements such as artificial intelligence.

Millennials and the middle class

The rapid growth of Millennials and the middle class is

transforming China’s society and consumption patterns.

The OECD estimates that, within a decade, China’s middle class will add a further 370 million people, taking the total to 1.2 billion. Middle-class spending power is expected to double over the same period to reach $14.5 trillion

There is also a generational shift underway which will have a profound impact on demand and consumption patterns. China’s total population is currently around 1.4 billion people, of which 351 million are Millennials. Not only is this demographic significantly larger than in the US – where approximately 73 million people are considered Millennials – it is larger than the entire population of the US.

Both demographics are associated with an increase in spending power due to a greater level of disposable income. This has enormous implications for consumption patterns for a number of reasons. A recent survey found that approximately 70 per cent of Millennials indicated that they were planning to increase their consumption of luxury goods and services in future, for example. Around 45 per cent indicated that it is essential to own at least one designer item. Overall domestic expenditure on luxury products was up by 13 per cent between 2016 to 2018, compared with a 7 per cent rise recorded between 2014 to 2016, according to PwC. The needs and wants of this demographic are likely to present a series of compelling investment opportunities.

China is still underrepresented in indices and is a land

of fundamental opportunities

Despite the fact that China has the second largest economy on the

planet, it is clearly under-represented in global equity indices,

which presents a potentially attractive landscape for active

stock-picking.

An examination of world market capitalisation, when divided along geographies, shows that China accounts for 15 per cent, which is almost equivalent to all European market capitalisation. However, the MSCI AC World index, a key global reference index, still allocates China a 5 per cent weighting.

China is home to a number of fundamental opportunities. For

example, China and US equities both have a similar exposure to

investment opportunities in sectors with high growth potential

such as the digital space. More than 40 per cent of the market in

the US and China is given over to providers of media and

entertainment, e-commerce, telecoms, IT hardware and

software.

Conclusion

The rise of China has created a wide variety of opportunities for

investors when it comes to key themes like the growth of the

tertiary sector, and the acceleration of consumption-led growth.

We believe that China is supported by strong fundamentals and has

capacity for further growth, which makes a strong case for China

equities in particular.