Wealth Strategies

Changing Asset Allocation Frontiers - An Overview

We take a dive into different approaches to how asset allocation should be handled, examine various views - including contrarian ones - and consider how attitudes about diversification have changed over time.

It is sometimes stated that asset allocation is the overwhelming driver of variation in investment returns. Everything else, such as selecting individual stocks and trying – often unsuccessfully – to time a market, pales into insignificance.

Back in 1986, a study from Gary Brinson, Randolph Hood, and Gilbert Beebower, - “Determinants of Portfolio Performance” (Financial Analysts Journal, July–August 1986) stated that almost 90 per cent of portfolio return variation is driven by asset allocation.

The devil is in the details, however – and given the tens of trillions of dollars/equivalents being invested today – that leaves plenty of room for other ideas. Active management, even with the caveats about markets being “mean-reverting” and the challenges of sustaining outperformance, can drive considerable performance dispersion. It is easy to make the case for “passive” investing (that adjective can be misleading, since any decision on how to invest is an “act”) when markets are steadily rising, but not quite so much when markets are treading water or showing heightened volatility.

Asset allocation is very much on people's minds. In this final quarter of the year, thoughts can often turn towards how wealth managers and private banks deploy clients’ money, and we have carried a raft of commentaries about the pros and cons of investing in the US, the impact of a devaluing dollar; shifts to emerging markets; the case for Japan, or India, and Europe. There’s also a fair amount of rumination about whether the old “60/40” equity/bond balanced portfolio makes much sense when – as has happened in recent years – stocks and bonds move in lockstep. And nowadays we have the rise of private market investing and moves even in the mass-affluent/retail space to hold private market assets. Joe Public, meet the Yale Model.

Another important topic that has caught more attention recently is “concentration risk”. When the “Magnificent Seven” US Big Techs account for as much as 34 per cent of the market cap of the S&P 500, as was the case in August, it heightens the danger that a reversal could hit those who think they’re diversified in holding a whole index. This leads also to concerns about whether investors’ advisors fully grasp what sort of indices they are exposed to, and how the reconstitution of indices can also lead to people to miss out on rises in values of certain firms. (See an article here.)

The asset allocation stance taken by a high net worth or ultra-HNW individual and family is clearly linked to risk tolerance and their goals. That tolerance might depend on whether the investors are still beneficial owners of an operating business that generates cash or rely on a pool of liquid assets after a firm has been sold. Asset allocation can also be fine-tuned for individual family members - what’s good for Mum and Dad if they are retired is not so appropriate for their adult children.

It is not just asset allocation that is important in thinking about where returns come from, but asset “location” is significant too. Remember, it is the after-tax returns that count. Fears that taxes such as capital gains could rise have, along with other forces, put the location of investments into the limelight to an extent that appears to be relatively new by the standards of recent years. For instance, getting details right – such as understanding whether a fund’s share class has a particular status, incurring either capital gains or income tax, can be crucial.

Laura Cooper, global investment strategist at Nuveen, reflected on the “location” point.

“Asset location considerations remain central to our planning. For example, we evaluate the relative advantages of holding certain real assets or private infrastructure through specific structures to optimise tax and regulatory treatment. Global diversification is balanced with careful consideration of local rules, and when recommending alternative or private strategies, we ensure structures are suitable for the client’s domicile and tax profile. Overall, we aim for alignment between asset allocation and holding vehicles to enhance net returns,” Cooper said.

Re-thinking 60/40

Among the reasons asset allocation ideas are changing is that

older assumptions have been severely tested. For example, a

traditional reliance on mixing equities and bonds to deliver the

goods no longer works, according to a recent White Paper from

Remi Olu-Pitan, head of multi-asset growth and income at Schroders.

“Creating resilience within portfolios requires a new approach and a new asset mix,” Olu-Pitan said.

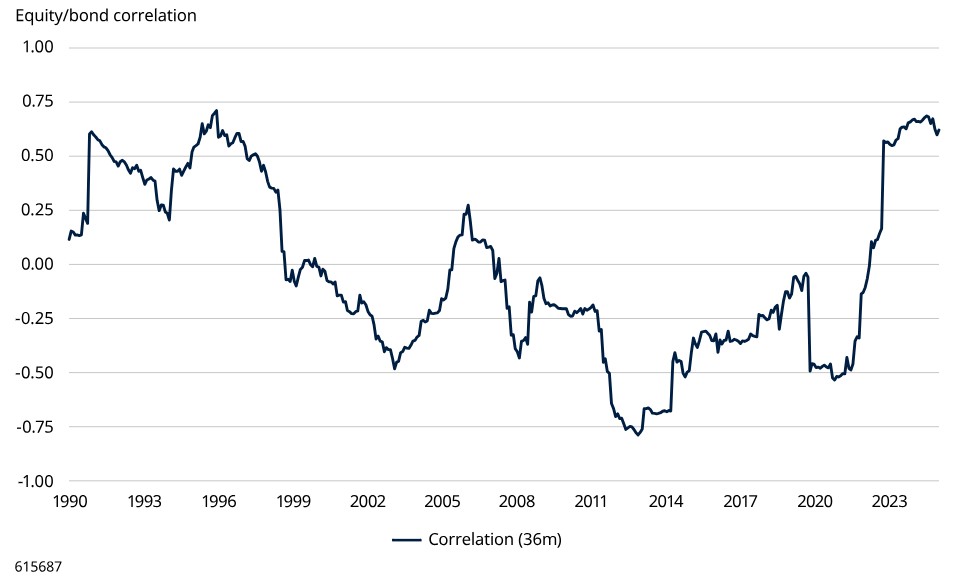

“Since 2022, global bond markets have been much more volatile and that has made bonds a less dependable source of returns,” he said. “The correlation between bond and equity returns rose significantly in the aftermath of the Covid-19 pandemic from a combination of factors that adversely affected both markets, including a spike in inflation driven by supply-chain challenges, soaring interest rates, a surge in commodity prices and geopolitical turmoil. The correlation has remained at elevated levels. As a result of all this, the 60/40 portfolio experienced severely negative returns, as exemplified by a US-focused portfolio. With its exposure to the S&P 500 Index and US Treasury bonds, the 60/40 portfolio was down nearly 18 per cent in 2023, posting its worst year since 1937,” he said.

Olu-Pitan illustrated the high correlations between bonds and stocks in the following chart:

Source: Robert Shiller, Schroders, LSEG Datastream. Equity returns are represented by the returns of the S&P 500 Index; bonds, by the 10-year US Treasury. As at 11 July 2025.

Fresh thinking

Olu-Pitan said that bonds “still have a vital portfolio role, but

their purpose has altered”.

Bonds cannot any longer be used for downside protection during volatile equity markets and should instead be mainly seen as an income-generating asset, alongside other income sources. Active portfolio management has got more important to reduce performance dispersion; there is also a need to consider alternative investments, such as commodities, hedge funds, private equity and private debt, because performance drivers are so different, he said.

Some of this loss of faith in the 60/40 model may partly explain why, for some investors, gold has been rising this year. A classic “safe haven” asset, it can add “ballast” to a portfolio. The World Gold Council, the industry group that generates data on gold markets and wider sector, is understandably positive on the yellow metal. “The negative correlation between returns from stocks and from bonds – once the cornerstone of a balanced portfolio is in a state of flux due to the volatile inflation backdrop. In terms of the implications for diversifying investor portfolios, it remains unclear where the equity-bond correlation will settle. But recent changes in the macroeconomic landscape call for a cautious approach. For those investors that don’t hold gold, this might prompt them to broaden their sources of diversification. For those investors that already hold gold, it might mean increasing their allocation.”

A controlled approach

In all the debates about what models work best, the time-frame

remains a crucial part of the puzzle. For a young adult, asset

allocation will be a different conversation than for someone in

late middle age counting down the years for retirement. And more

broadly still, there's a need to be composed and avoid churning

portfolios.

Chris Miles, head of UK and Ireland client group at Capital Group, said a medium-term perspective is important to avoid being pulled around by immediate headlines.

“The most effective approach is one anchored in long-term thinking and deep, fundamental research. Rather than attempting to time the market or position for binary outcomes, our process focuses on building resilient portfolios through global diversification and flexibility,” Miles said. “We deliberately avoid making concentrated bets on specific scenarios, recognising the vast array of unknowns across the global economy. Instead, we seek to identify businesses with enduring competitive advantages, quality leadership, robust balance sheets, and sustainable growth potential - across regions and sectors.”

When this publication spoke to several investment houses, the enduring verities around the need for diversification – and keeping flexible in the face of rapid change – came through. The gyrations of government policy in the US, such as around tariffs, for example, have tested investors’ nerves and galvanised thinking about hedging strategies and ways to manage risk.

“The key over the coming quarters will be to remain selective, diversify across asset classes and regions, and seek value in areas where fundamentals are stronger than current pricing suggests,” Nuveen’s Cooper said. “While headline risk remains elevated, opportunities are emerging. We are incrementally more positive on US large-cap equities due to robust earnings resilience and improved sentiment. Fixed income markets offer compelling yields, particularly across municipal bonds and securitised assets, whilst real assets and listed infrastructure also provide potential income and stability. Strategic allocation needs to account for ongoing volatility but also avoid overreaction to short-term noise.”

“In an environment characterised by policy unpredictability and sharp swings in sentiment, we are seeing greater use of derivative overlays, particularly options strategies to manage downside risk and enhance income,” Cooper continued. “These are often integrated into multi-asset portfolios and explained to clients as tools to cushion volatility or monetise periods of heightened uncertainty. Cost is carefully weighed against potential benefits, with strategies typically stress-tested and reviewed regularly. Transparency is key, and clients are increasingly familiar with these instruments being part of a robust risk management toolkit.”

Unduly unloved

Certain asset classes deserve more attention, argues Nuveen’s

Cooper.

“We believe municipal bonds have been unfairly discounted. Despite solid state and local fundamentals, they have lagged broader bond markets this year. With yields close to decade highs and a steeper curve than US Treasuries, we see value particularly for long-term investors. Real estate also appears overlooked. While office remains challenged, sectors such as senior housing, grocery-anchored retail and medical office space are supported by structural demand drivers. Infrastructure, especially related to energy and data, deserves renewed focus due to growing power demand and supply constraints,” she said.

Quite contrary

In all the conversations about asset allocation, it is noticeable

that wealth managers are keen to differentiate their styles and

stand out. That can include taking a contrarian investment

philosophy.

“One contrarian stance we hold is a continued overweight to US large cap equities, particularly given the `sell the US’ narrative that dominated earlier this year and ongoing concerns of stretched valuations,” Cooper said. “Despite geopolitical tensions and currency pressure, fundamentals remain strong, as captured in second quarter earnings, with profit growth still expected to outpace Europe and China in coming quarters. We are also constructive on securitised credit and preferred securities, where spreads and fundamentals offer attractive entry points, even as other investors remain cautious. Lastly, we believe the infrastructure demand, linked to AI and electrification, is underestimated by the broader market.”

Jim Caron, chief investment officer of the portfolio solutions group of Morgan Stanley Investment Management, is also going against the "sell the US" narrative.

"We think full-year 2025 earnings estimates may be understated in analyst expectations by about $9, based on the historical relationship implied by the run rate of the year’s earnings. This may be because analysts are hedging downside economic surprises due to the fallout from future tariffs. We think data slogs through, which provides room for upside earnings surprises in the second half of 2025. This would not only lead to further earnings increases into 2026 but also suggest that current P/E valuations may be overstated. It is the basis of why we are looking to add to US equity exposure for the second half of this year.

This publication asked Caron for some tactical as well as

strategic asset allocation views.

"The second half of 2025 will resolve the uncertainty stemming

from first half of the year surrounding tariffs, budget and tax

policies in the US. It remains to be seen if the fallout from

tariff policies leads to a more pronounced slowing of economic

activity and higher inflation - the stagflation scenario - or if

the economy muddles through without a recession. Our view is the

latter. The resolution of the US budget and tax plan could be a

tailwind for economic activity as it may add stimulus through

accelerated depreciation, increased capital expenditure (cap-ex)

and further deregulation that shifts the engine of growth from

the government to the more productive private sector.

“We expect more productive growth over the next sis months. An underappreciated change in policy is the reduction in Federal outlays/spending that is starting to take hold. Post Covid, government spending and policies influenced and crowded out private sector activity from employment growth to Green initiatives that influenced corporate spending and investment. This change in policy is hard to measure immediately but instead shows up in business investment and [capital expenditure], which, in turn, feeds into GDP. The big difference is that it is driven by the private sector, not public, such that invested money has a higher multiplier effect,” Caron said.

Asset allocation approaches are changing in a variety of sectors, including among philanthropists.

Most charities expect to pivot more of their capital towards active investments amid volatile markets and shift their investment portfolios towards equities and alternatives over the next two years, according to interviews with senior charity executives conducted for Rathbones. The UK wealth manager talked to 100 UK charity board directors, finance directors, investment managers and investment directors with a collective £3.7 billion of stock market related investments. The survey found that 87 per cent expect their active investment allocations to increase, either slightly (49 per cent) or dramatically (38 per cent) over the next three years.