Technology

Asset Tokenisation: Why Wealth Managers Must Get In The Game

A private banking house argues that distributed ledger technology such as blockchain and asset tokenisation must be taken seriously by the wealth management industry. A big first-mover advantage is there to be seized.

This news service continues to share ideas from the private banking sector about the kind of technology that is changing the world of finance and investment. And of course it is hard to move today without coming up against bitcoin and the associated areas of blockchain distributed ledger technology and “tokenisation”. What is tokenisation and why does it matter? To answer these questions is Jeroen Van Oerle, who is global fintech portfolio manager, at Lombard Odier Investment Managers. The editors are pleased to share these insights; the usual editorial disclaimers apply. We welcome our readers to jump into the conversation. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

What is tokenisation?

In a nutshell, the tokenisation of an asset is the issuing of a

token as a digital representation of that asset, administered on

a blockchain. It allows investors to own a more diverse selection

of assets beyond the traditional choices of equity and fixed

income. Art, classic cars and real estate are all examples of

assets that can be tokenised and incorporated into investors’

portfolios.

The benefits of tokenisation over other forms of trading are, in some cases, simply down to cheaper, more efficient and secure infrastructure, but there are also completely new use-cases which would not be possible without blockchain.

Fractional ownership of direct real estate is an example of an asset class that is impossible without asset coins; owning a REIT or asset-backed securities is not the same as owning a direct claim to the underlying asset. Likewise, owning part of a painting is a potential future new use-case too. Gold coin, on the other hand, is an ownership claim to physical gold, which is stored in a vault. It was already possible to trade in gold (futures and forwards for example), but the entire process is much more (cost) efficient when executed in the form of tokens.

Asset tokens are no fantasy. There are several examples of assets that have been tokenised and new rules and regulations are emerging continuously. The tokenisation industry is maturing and is moving beyond the cryptocurrency hype.

How will it impact the asset management

industry?

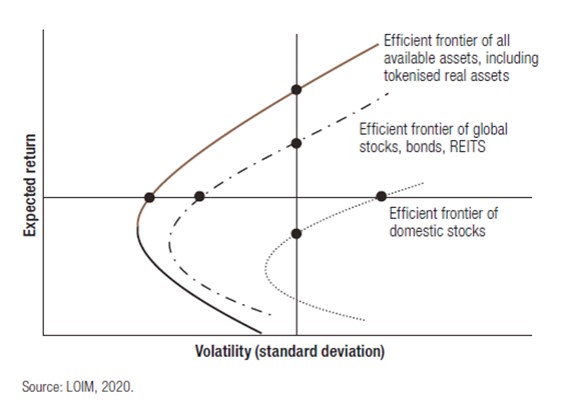

The impact of asset tokens on the asset management industry is

diverse. It is highly likely that the correlation of these asset

tokens to traditional equity, bonds and REITS is lower than one,

implying that there are diversification benefits from adding

asset tokens to the portfolio. Simply said, the expected return

per unit of risk increases (or the risk per unit of expected

return decreases), in our opinion, because of token inclusion, as

can be seen in the graphic below.

Today it is mainly in an institutional setting, where there is enough money available to own a wide range of uncorrelated assets. Thanks to asset tokenisation, though, retail portfolios can now benefit from the same level of diversification. This results in the democratisation of real asset investing, opening up institutional opportunities to the mass market.

From a practical perspective, tokenisation will also change the

asset management industry. These tokens all need to be analysed,

which implies asset managers need to employ art experts, direct

real-estate experts, music copyright experts and a long list of

asset experts that become available for investing.

Asset managers can specialise in asset categories and offer tailored solutions/advice to their clients. Besides the expertise needed to analyse these assets, portfolio management changes as well because the asset mix expands. It is not likely that investors will fully optimise the complex risk-return equilibrium for their portfolio when asset tokens are included. Tools need to be developed by (automated) wealth managers to offer such portfolio optimisation and we are likely to see an increase in algorithmic trading in order to take advantage quickly during illiquid periods. We believe managing portfolios will be a more combined effort of fundamental analysis and algorithmic trading. In our view, the investment industry will change once asset tokens become mainstream.

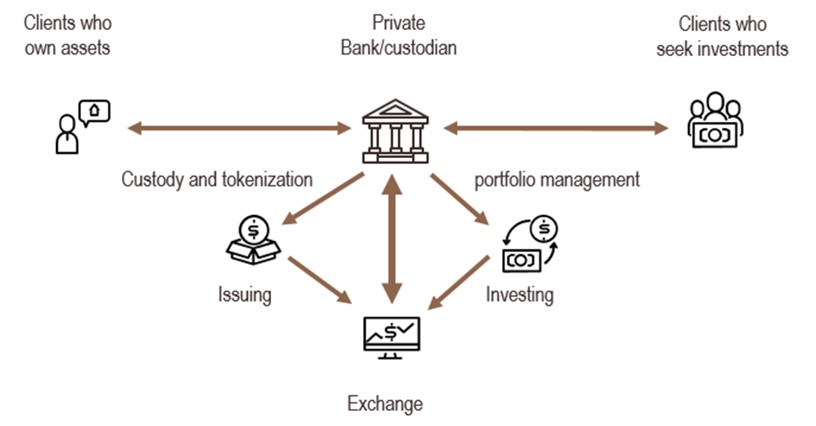

There are many new “jobs-to-be-done” once asset tokens become part of the investable universe for a broad audience of investors. Within the traditional wealth management value-chain, we believe that private banks are set up best to benefit from real asset tokenisation, as can be seen in the graphic below.

Source: LOIM

Evolution or revolution?

In the great work on disruptive innovation by Professor Clayton

Christensen, there are three different types of innovation.

Efficiency innovation, where processes become more efficient over

time thanks to small incremental changes to existing technology;

sustaining innovation, where new technology is applied within the

existing market dynamics; and disruptive innovation, where a new

technology serves a new client group but eventually becomes the

dominant technology for a broad range of functionalities. We

would classify tokenisation as sustaining innovation, with

disruptive elements.

The reason we say this is sustaining in nature and not fully disruptive is because traditional service providers are able to integrate this new technology in order to improve on their existing functionalities. Just as with the internet, not all brick-and-mortar services disappeared, only those who did not integrate the new functionalities now find themselves on the losing side. This is profoundly different from feature-phone providers, which became redundant when smartphones took over the market. Therefore, as long as the asset management industry integrates this new technology into their existing offering, it will be sustaining innovation.

There is, however, a possible feature that could lead to disruptive characteristics in this case and that would be the shortage of IT knowledge and talent. If traditional wealth management providers want to integrate asset tokenisation into their offering, but do not have the capabilities in house to do so, clients will simply switch to a different provider who does have the capability to integrate the full spectrum of investable assets.

We strongly believe in the evolution, not revolution path. Cryptocurrencies have been the first application on a new infrastructure named blockchain. We are now finding out that there is much more to be done with that underlying technology. Asset tokenisation and distributed autonomous organisations show a lot of potential, and both are powered by distributed ledger technology. Within the financial sector, in particular, rules and regulations need adhering. This is an important factor in the evolution versus revolution discussion. Because of the regulatory requirements, it will take longer before the technology is adopted throughout the industry. Ultimately, the hurdles that need to be overcome are: technology, rules and regulations, networks and trust.

A technology standard is not yet agreed upon, which makes it hard to integrate different solutions. Rules and regulations move slowly. Networks are being formed, but that also takes time. The benefit of networks is that scale and cost advantages grow exponentially with the number of users in a network.

Finally, trust is hard to gain but easy to lose. It took a long time before people understood the difference between blockchain and bitcoin, but it can also take a long time for investors to understand that cryptocurrencies are very different from asset tokens. Trust in the latter probably needs a lot of time, which contributes to the evolution rather than revolution of asset tokens.

Despite the fact that the ultimate path to adoption will probably take a long time, complacency is dangerous. We think that the impact of distributed ledger technology and the introduction of asset tokens require serious strategic decision-making and preparation. Ultimately, the first-mover-advantage in wealth management can be large.