ESG

Asia, Driving The Green Engine Transition

The author argues that worries about constraints over rare-earth supplies are as misconceived as fears of "peak oil" were decades ago. Furthermore, moving to "greener" forms of energy and industrial production is going to be a big source of Asian economic growth.

To what extent are firms which operate under the tag of “green” or “sustainable” propelling the economic growth of Asia? Is this all for the good, or are there problems and costs to consider? “Going green” might be profitable, but debate remains on whether this can be carried out easily and without some bumps along the road. (Moving to electric vehicles and the extensive use of batteries requires, for example, a great amount of lithium and rare earth metals.) To address the situation is Saurabh Chugh, portfolio manager at Fullerton Fund Management. The editors of this news service are happy to share these insights; the usual editorial disclaimers apply. Join in the debate! Email tom.burroughes@wealthbriefing.com

There is no doubt that ESG investing in Asia has a unique set of challenges, from diverse regulatory frameworks – where ESG disclosures vary greatly – to the lack of sufficient incentives for companies to adopt sustainability-related best practices. This is compounded by the unavailability of data sets, unreliable information from rating agencies, and limited influence due to Asian primary ownership structures (state-owned, controlling-shareholder-driven).

It is undeniable that Asia is playing catch up in terms of setting ESG targets, but with every challenge there comes an opportunity. In this case, it means that investors can capitalise on the investment opportunities early in their growth journey. We believe that improvements in ESG credentials may lead to equity outperformance for the company.

Local knowledge will be key to finding significant alpha opportunities among companies exhibiting an improvement in ESG and those contributing to the “green engine” transition, and we cannot forget that Asian companies are global leaders in selected green technologies.

.jpg)

Asian companies must respond to increasing pressures from regulators, clients and investors to integrate ESG consideration into their business strategies, and there is an early-mover advantage on ESG in Asia, especially China.

The COVID-19 environment, coupled with greater geopolitical risks (driven by the Russia-Ukraine war), and supply constrained resources, is likely to reinforce de-globalisation trends over time. Energy prices have increased significantly and could prove to be higher for longer than otherwise envisaged, as investment and supply are still recovering. In many respects this highlights the need to accelerate the transition away from fossil fuels to clean and renewable energy.

In moving towards green energy, natural gas is commonly regarded as a transitional fuel. That is because, relative to its counterparts, it is a cleaner burning fossil fuel, but its main drawback is that it is not a renewable source of power. Nuclear energy is also non-zero carbon because, over its complete fuel lifecycle, emissions are significant – from mining, enriching, construction, and decommissioning (including the problem of radioactive waste storage). That said, all energy sources have some greenhouse gas emissions over their fuel lifecycle – no energy source is completely green, rather there is a spectrum of ‘shades of green.’

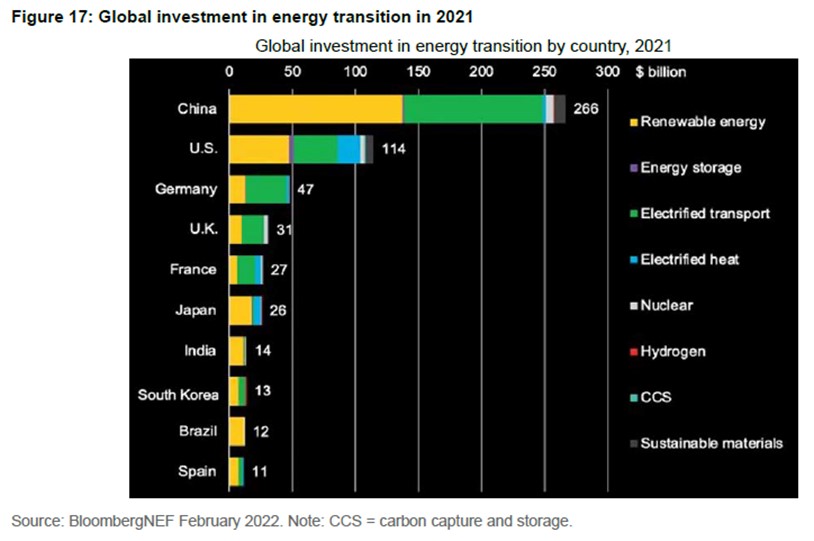

China, the world's biggest source of greenhouse gas emissions, has been criticised for continuing to approve new coal-fired power stations and only promising to cut its coal usage after 2025. At the same time, however, China is also the world’s biggest spender on investments to transition to cleaner energy. Last year China spent $266 billion (a 35 per cent share of total global spending. See the figure below) on such infrastructure, dominated by solar renewables and electric vehicles.

What this illustrates is that moving towards renewables is a huge undertaking for the largest economies, which requires time and the balancing of multiple objectives. China’s long-term goal, to reach peak carbon usage by 2030 and carbon neutrality by 2060, implies that its spending every year will remain significant.

This may create a prolonged double boon for investors in China, with opportunities across infrastructure investment, followed by greater spending on renewables. Chinese companies are well positioned to benefit, not just from strong demand for renewables at home, but also from abroad. For example, China is the largest exporter to Europe; to be spearheaded by new wind and solar projects, Europe has pledged to get an extra 5 per cent of its energy from renewables by 2030 (i.e., increasing its target to 45 per cent from 40 per cent for EU energy from renewable sources. Source: 18 May 2022 Reuters).

A good example of a leading company driving China’s green transition is Contemporary Amperex Technology LTD (CATL). Specialising in the manufacturing of batteries for EVs, as well as battery management systems, it has become the largest lithium battery manufacturer in the world (with a global EV battery market share of circa 33 per cent in 2021). Over the next five years or so, China is likely to continue to dominate global alpha opportunities across investments in solar, wind, and power grid upgrades.

Investors should not stress too much about the constrained supply of rare-earth metals that are used in developing renewable energy. Back in late 2010 there were acute worries about shortages of rare earths, as China began limiting its exports and the prices of key materials surged. These fears abated over time, however, as other countries moved to extract and process alternative supplies. At the same time, recycling, and much more efficient use of rare-earth metals in the manufacturing of renewables, has significantly lowered world demand for newly-extracted materials.

In many respects, concerns about rare-earth supplies have similarities to the misguided fears of “peak oil” – fears which were first raised back in 1938. What investors have learned over time is that whenever there is economic coercion, market forces motivate new technologies, extraction innovations, and production efficiencies, that collectively enable demand to be met.

About the author

Saurabh Chugh is responsible for managing Asia equity

strategies and also provides research coverage of telco sector as

well as India. Additionally, he is also the equities product

specialist in the team.

Chugh joined Fullerton in 2015. He was previously from CLSA,

where he was their lead analyst covering Singapore-listed

industrials, conglomerates, oil services and telecoms stocks.

Saurabh also provided research coverage for the utilities,

airline and healthcare sectors. Prior to CLSA, Chugh worked at

corporate finance firms in London, as well as at the Energy &

Resources Institute in India, where he was engaged in providing

advisory services in the environmental sustainability

sector.