WM Market Reports

APAC Wealth Clients Most Likely To Fire Advisors – EY Study

In its annual study of wealth management, EY, the accountancy and professional services group, said that APAC clients are generally more likely to switch service providers than their global peers.

Affluent individuals in Asia-Pacific are more willing to fire wealth providers and choose another than is the case for the global peers, showing that firms in the region must stay competitive to retain business, an EY report shows.

The 2025 EY Global Wealth Research Report also shows that clients are keen on AI tools. Almost three-quarters (72 per cent) of respondents in APAC expect their wealth managers to use AI in some capacity – higher than the global average of 60 per cent.

The study, which is based on a survey of almost 3,600 wealth clients in 30 countries, was conducted from the end of October to 24 December last year. About 1,100 respondents came from the APAC region.

More than a third (36 per cent) of Asia-Pacific respondents said they will probably change their primary wealth provider within the next three years, compared with a global average of 29 per cent. The trend is even more pronounced in China, where more than half (51 per cent) of respondents said they are open to switching providers.

“This shift signals a fundamental redefinition of what clients now expect from their wealth managers. It’s no longer just about delivering returns; it’s about providing a broad, personalised experience that leverages the best of human insight and digital innovation,” Elliott Shadforth, EY Asia-Pacific wealth and asset management sector leader, said. “Wealth managers must move beyond traditional models and embrace a more agile, technology-enabled approach that aligns with evolving investor priorities – whether it’s access to alternative assets, ESG transparency, or AI-powered advisory.”

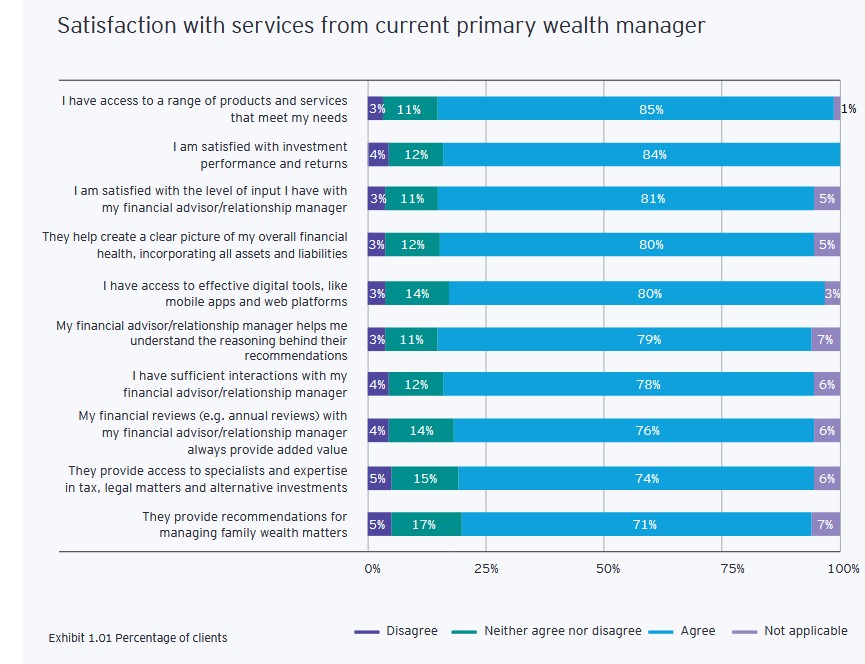

Below, a chart showing clients' satisfaction with their wealth managers (all regions):

Source: EY

Big shift

Some 74 per cent of APAC respondents expect to move at least

one-quarter of their portfolio away from their primary provider,

with most (48 per cent) planning to move up to half and 25 per

cent of them intending to move most or all of their portfolio

away.

Reflecting on choppy markets: 51 per cent of clients in APAC have increased the number of planning meetings with their financial advisors – well above the global average of 44 per cent.

“Clients are no longer passive recipients; they are empowered decision-makers who are seeking providers that can help deliver customised, innovative solutions,” Patricia Tay, EY APAC banking and capital markets sector leader, said.

Asset classes

Real estate continues to dominate as the most popular alternative

investment class in APAC, with 68 per cent of respondents

including it in their portfolios. However, interest in other

alternative assets is gaining momentum, with more than 30 per

cent of respondents expressing willingness to invest in asset

classes such as collectables and artwork, hedge funds, private

credit and secondaries.

Sustainable investing is also gaining traction. Some 37 per cent of APAC respondents already invest in transition-focused financial products, with another 44 per cent showing interest in doing so.

In the digital asset space, Asia-Pacific continues to lead. EY said 43 per cent of respondents reported that they were investing in crypto and other digital assets, compared with a global average of 33 per cent.

Ultra-keen on AI

Digital capabilities are important to ultra-high net worth APAC

clients. Around 39 per cent of them consider that access to

advanced digital tools and technologies is the most

important factor when choosing a wealth provider, compared

with the global average of 34 per cent. Younger clients in

particular, who have noticeably higher expectations

of AI-driven advisory tools and services, are leading this

trend.

Cost anxiety

The report said that despite improvements in transparency, 49 per

cent of clients globally – and higher in regions such

as Asia-Pacific – are concerned about hidden costs. This

creates a “potentially damaging source of mistrust that wealth

managers might want to address,” the report added.