Legal

AMP Shares Slide Further Amid Fresh Lawsuit

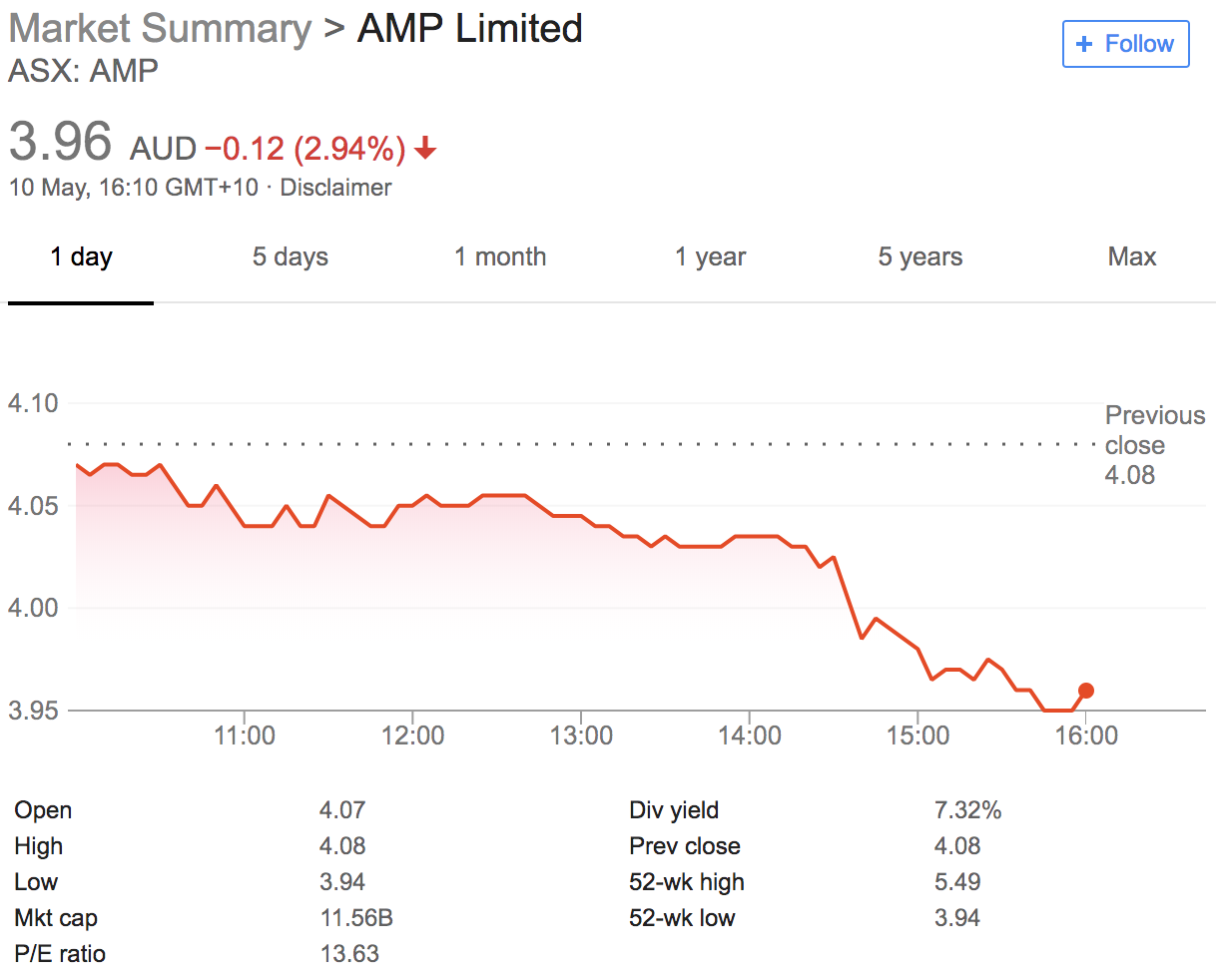

AMP, one of Australia's largest pension funds, saw its shares slide further in yesterday's trading after it was announced a global law firm had filed a class action lawsuit against it on behalf of disgruntled investors.

Quinn Emanuel, a global law firm, has filed a lawsuit against Australia’s AMP over allegations of criminal misconduct that have sent the wealth manager’s shares sliding.

Quinn Emanuel filed the class action on behalf of AMP shareholders who were left angry and out of pocket after around A$2 billion ($1.49 billion) was shaved from the firm’s market capitalisation following admissions from AMP executives made during a government-backed probe into Australia’s banking sector.

"The class action alleges that, amongst other things, AMP breached its continuous disclosure obligations and made misleading statements, causing shareholders significant loss," the law firm, whose full name is Quinn Emanuel Urquhart & Sullivan LLP, said in a statement.

Source: Google

The class action, filed at the Supreme Court of New South Wales and backed by Burford Capital, is the first against AMP.

Three directors left AMP earlier this week following the exit of the firm’s chairman, chief executive and in-house lawyer, after revelations at the inquiry, officially called a Royal Commission, revealed AMP had lied to regulators and allegedly doctored an independent report.

The Royal Commission, expected to last around a year, has unearthed widespread malpractice in Australia’s banking sector, cranking up the heat on the nation’s four largest lenders – ANZ, Commonwealth Bank of Australia, National Australia Bank and Westpac – and other large financial institutions.