The chief executive of Australia’s largest wealth manager, , has resigned after a probe revealed his firm had engaged in widespread misconduct.

Craig Meller, who had held the position since 2014, has stepped down with immediate effect, AMP said last Friday.

Meller said he was “personally devastated” by the revelations of Australia’s Royal Commission into the nation’s banking sector, adding that he did not “condone” AMP’s practices but “as they occurred during my tenure as CEO I believe that stepping down as CEO is an appropriate measure”.

Day by day, the Royal Commission, which began in February and is expected to last around a year, is unearthing more malpractice in Australia’s scandal-ridden banking and finance sector. Meller is the first top executive to lose his job as a result of the inquiry.

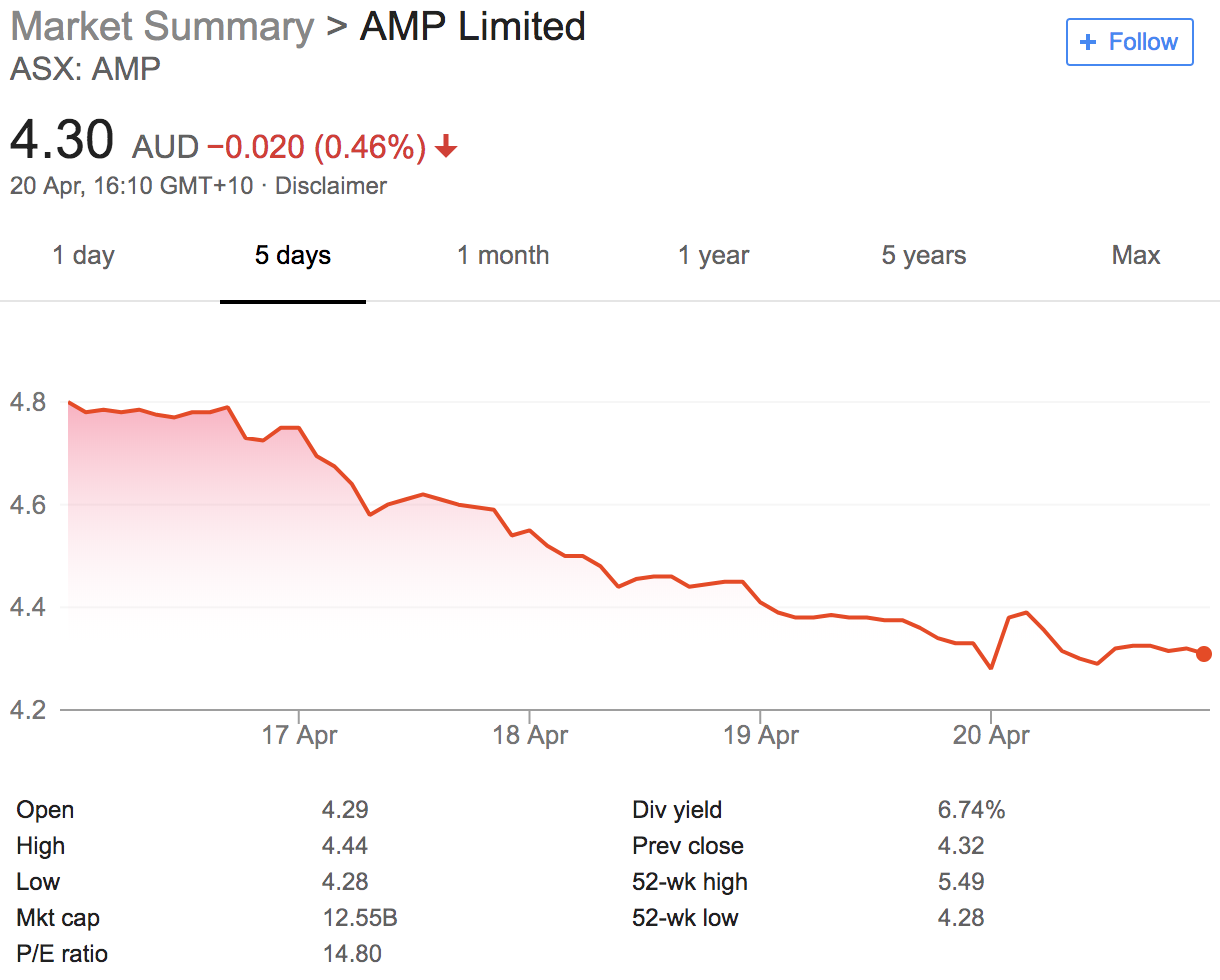

Since AMP employees began giving testimonies at the inquiry early last week, the firm’s share price has been sliding. AMP closed at A$4.32 ($3.32) on Friday, down 10 per cent from Monday’s closing price.

AMP's share price movements last week. Source: Google.

Employees’ testimonies revealed that AMP had charged clients for advice they never received and then lied to the Australian Securities and Investment Commission (ASIC) about the practice for nearly 10 years. The revelations were concurrent with practices at ANZ, which earlier this month was ordered to pay A$3 million and submit regular reviews of its systems and processes after billing thousands of wealth management clients for services they didn’t receive.

ASIC has been hot on the heels of crooked advisors. Since launching its wealth management project in October 2014, the watchdog has banned 45 advisors and one director from the industry.