Reports

UBS's Pre-Tax Profits Rise

Profits rose, while there was a fourth-quarter net outflow from the wealth management operation amid tough market conditions, it said.

UBS yesterday reported a fourth-quarter pre-tax profit of $862 million, rising by 2 per cent from the same quarter a year ago, while net profit surged by 25 per cent to $4.9 billion, with the year-on-year rise inflated by the US tax changes of late 2017.

On an adjusted basis, pre-tax profit for 2018 rose by 2 per cent, standing at $6.4 billion in 2018.

For the fourth quarter, net profit attributable to shareholders was $696 million, below a consensus forecast $729 million. Total invested assets across wealth management and other business units fell and the wealth arm sustained a drop in transaction-based revenues amid difficult markets. In Q4, there was a total net outflow from the wealth management arm of $7.5 billion, amid increasingy testing market conditions. For the whole of 2018, there was $24.7 billion in net new money, below the figure for 2017.

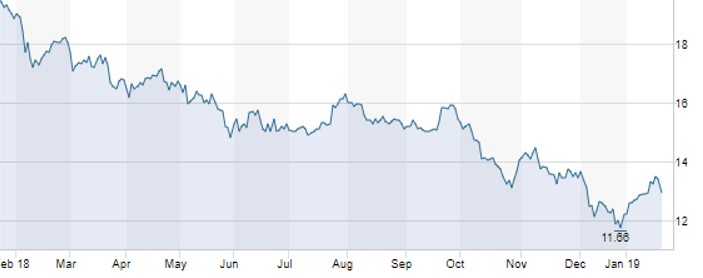

Shares in the bank softened on the results.

Source: SIX Exchange

The Zurich-listed bank has moved to reporting all its financial results in dollars, having flagged its intention to do so in its third-quarter statement. With such a significant amount of its earnings no longer being booked in Swiss francs, the lender decided that the switch made more sense and would reduce potential distortions and volatility in its earnings.

News stories have recently speculated on who might eventually take over from Sergio Ermotti. He has been chief executive since 2011 and was at the helm when UBS de-risked its investment bank arm and shifted its focus to wealth management. Today’s results statement made no reference to Ermotti’s CEO position.

“We've seen some normalization in markets early in 2019; we will stay focused on balancing efficiency and investments for growth, in order to keep delivering on our capital return objectives while creating sustainable long-term value for our shareholders,” he said in a statement.

Wealth management

At the group’s global wealth management arm, covering businesses

in the Americas, Asia, Europe and other locations, net new money

totalled $24.7 billion for the year. The adjusted net margin was

17 basis points.

Recurring net fee income and net interest income both increased year-on-year on higher invested assets during most of 2018, further progress on mandate penetration, as well as increased net interest margin on deposits and higher loan volumes.

The wealth business’s adjusted cost/income ratio was 76 per cent.

UBS had a CET1 capital ratio – a standard test of a bank’s capital buffer - of 13.1 per cent.

Total invested assets at the firm stood at $3.101 trillion at 31 December 2018, against $3.262 trillion at 31 December 2017.