Technology

Don't Get Bitten By FAANGs, Warns Fund Manager

Big equity market shifts and high valuations for a number of these big-tech firms have shined a spotlight on whether they remain smart investments.

The investment industry loves its acronyms: remember the BRICs? Then there are all those terms in day-to-day finance, such as EBITDA, EPS and so on. And more recently we have seen chatter around those scary-sounding “FAANGs”, which stands for big-techs Facebook, Apple, Amazon, Netflix and Alphabet’s Google. There have been some jaw-dropping (‘scuse the pun) movements in the share prices of these firms, such as Facebook’s sharp fall last week, wiping billions of dollars of its share price. This article explores how sharp these “FAANGs” still are and is by David Keir, co-manager of the TB Saracen Global Income and Growth Fund. The editors of this news service are pleased to share these insights. The editorial team doesn’t necessarily endorse all views of contributors. Readers who wish to respond can email tom.burroughes@wealthbriefing.com

For too many investors, holding FAANG stocks (Facebook, Apple, Amazon, Netflix and Alphabet’s Google) is coming to be an obligatory part of the investment process. These firms’ valuations are often based on optimistic assessments of their future growth potential, and when it becomes apparent these projections are erroneous the correction can be dramatic, as the recent plunge in the share prices of both Facebook and Netflix demonstrates.

Although we believe there is value in the technology sector, investors need to have their wits about them and remain conscious of valuation. Technology has performed very strongly in recent years and now makes up a large part of global equity indices (see table below). Whilst we have been finding value in some of the US “old tech” names, we observe an increasing number of red flags for investing in the sector.

One key fact to note is the continued shift to passive investing and the increasing prevalence of the use of exchange traded funds is creating a virtuous circle for the “FAANG” stocks, which make up the largest part of the US equity market. As investing through passive/ETF vehicles involves buying shares without any regard to valuation it is easy to see how the FAANGs can rapidly become overvalued. The growth in passive investing and particularly ETFs is a relatively recent phenomenon that has undoubtedly worked well for both investors and the FAANG stocks during the elongated bull market. However, this may unwind rapidly if and when markets turn.

It is becoming apparent to us that some investors are now taking a top-down view on the sector and targeting a specific weighting in the sector irrespective of the valuation of the underlying stocks. This suspension of the investment process is very noticeable in both UK and European markets where there is a scarcity of tech and investors have to pay very full multiples to gain exposure.

One prominent example of this trend in the European market is Amadeus IT, a Spanish listed company that provides IT services for the travel and tourism industry. In 2014, Amadeus IT’s shares were trading on 16X Year 1 price/earnings ratio (PER), 10X Year 5 PER and yielded 3 per cent. Today the shares trade on 28X Year 1 PER, 17x Year 5 PER and yield 1.7 per cent. Although Amadeus remains a strong company it is arguably no longer a good investment. It is unclear precisely how much of the re-rating over the last four years is due to Amadeus being a tech stock; the company’s flawless execution of strategy and investors’ willingness to pay up for growth are likely to have played a role but we suspect it forms a prominent part of the explanation.

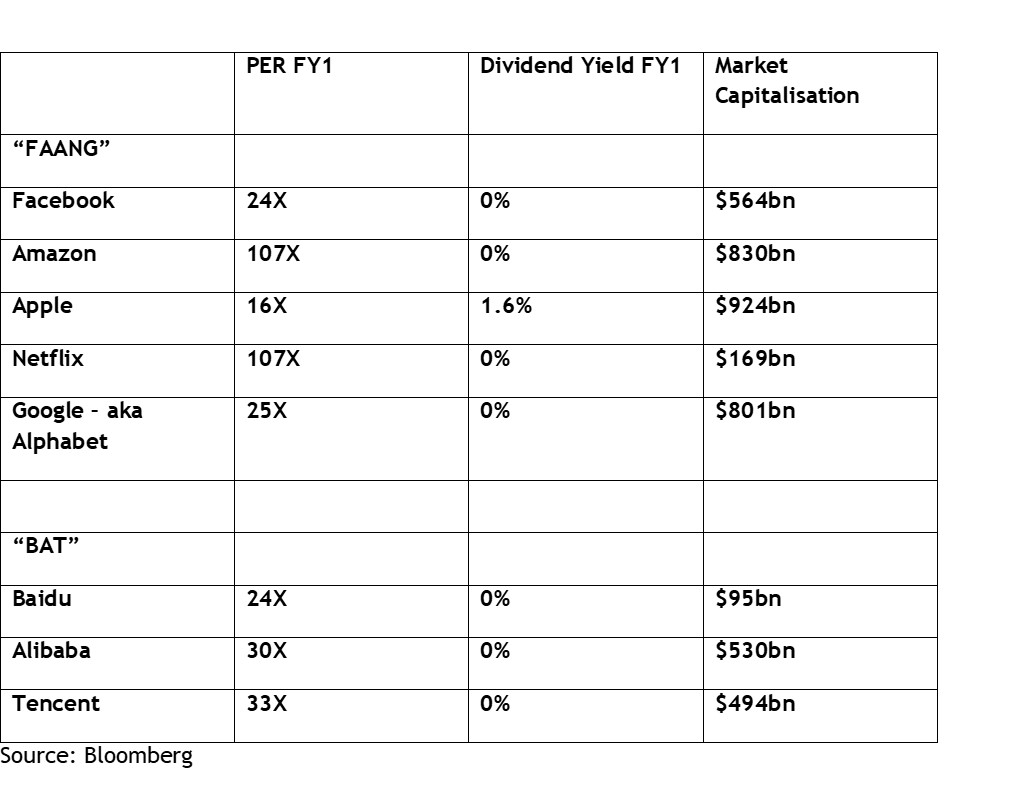

This pattern is repeated across the sector. As the table below highlights, the US “FAANG” stocks and their Chinese equivalents – “BAT” – are expensive on strict PER metrics and have no dividend yield support. Indeed, some of these stocks don’t generate any free cash flow.

“FAANG and BAT stocks”

In an environment of lower global growth, there is admittedly some rationale for paying a premium for faster growing businesses. Nevertheless, many of the highly valued tech businesses are very large already, with market capitalisations in the hundreds of billions of dollars and share prices already discounting substantial future returns. Many of these tech businesses must therefore be considered high risk investments, with little if any yield protection to support the share price in the event of any disappointment.

Indeed the market capitalisation of these relatively young companies, which are disrupting many aspects of business and the everyday lives of consumers, remains staggering. We suspect that at some point governments across the world will have to look at the regulation and taxation of these companies.

It is hard to categorically state that any of these businesses are overvalued. However, investors have priced in bold assumptions on the future rate of growth, technological change and challenges to their market positions both from new entrants and regulatory challenges: these multiples leave little room for error.

Crucially, while the growth drivers that are helping the sector currently, namely the shift to cloud, the internet of things, machine learning and autonomous vehicles are very interesting, we believe “older” US tech stocks are actually a much cheaper way of playing these trends.

For example, Cisco, IBM and Intel all have the characteristics value-orientated investors should look for in any investment. Their valuations are low because they are not pure plays on the new growth drivers; however they are all investing massively in next generation technology.

For example, Cisco is transitioning its business model away from a traditional “book and ship” every quarter model to a combination of hardware, software and recurring revenues. It is also now a global market leader in the fast growing software security market.

IBM has created a “strategic imperatives” division which is growing 10 per cent to 15 per cent per annum and now represents over 40 per cent of group revenue. Long-term, IBM hope to be able to monetise their significant investment in Watson, their supercomputer, which combines artificial intelligence and sophisticated analytical software as a “question answering” machine. Today Watson is predominantly being used in the healthcare sector providing quicker and more accurate diagnosis for patients. Over time this will be rolled out across many different markets.

Intel is trying to evolve from a personal computer company to one that provides the infrastructure for this increasingly smart and connected world. The main push for Intel over the next few years are its data centre business, where Intel’s microprocessor chips help power the cloud servers of Amazon and Microsoft, as well as its internet of things division, where Intel hopes to contribute to the software running autonomous cars. It has been interesting that both Intel and Cisco have started to re-rate on higher earnings numbers over the last 9 months since both businesses started to grow again.

We hope that Cisco, IBM and Intel can become the next “Microsoft”. Seven years ago, Microsoft was a “hated” stock as it was on a Year 1 PER of 9X, Year 5 PER of 7X, yielded 3 per cent and had over 20 per cent of its market capitalisation in cash. The low valuation was due to investors being concerned about the longevity of its office and windows products. Over the past seven years, Microsoft has transformed itself from a value to growth stock as it has refreshed and successfully monetised its office and windows products and also created a global leading position in cloud servers from which is derives an annualised revenue of $20 billion. The shares have therefore re-rated on a significantly higher earnings number to 23X Year 1 PER and now only yield 1.7 per cent.

We remain convinced there is value to be found in tech, if you know where to look. What is clear, however, is that investors should not fall into the trap of feeling FAANGs need to form an obligatory part of their portfolios. Other opportunities exist in the tech market, especially among older names and it would be wise not to overlook them.